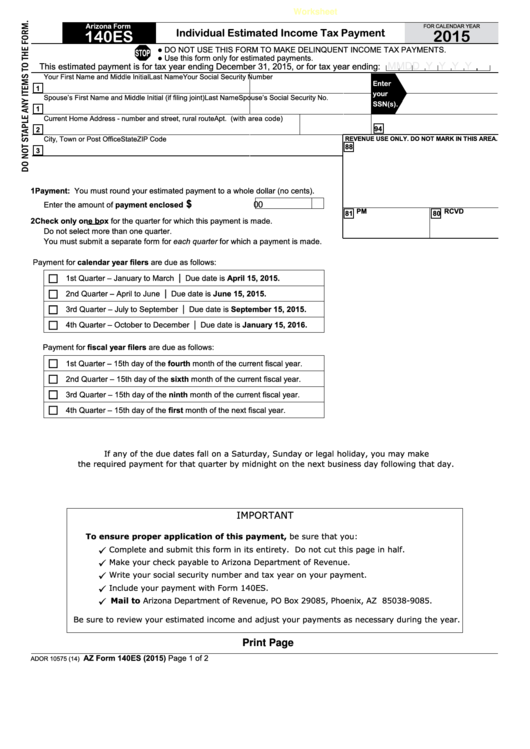

Worksheet

Arizona Form

FOR CALENDAR YEAR

Individual Estimated Income Tax Payment

2015

140ES

DO NOT USE THIS FORM TO MAKE DELINQUENT INCOME TAX PAYMENTS.

STOP

Use this form only for estimated payments.

M M D D Y Y Y Y

This estimated payment is for tax year ending December 31, 2015, or for tax year ending:

Your First Name and Middle Initial

Last Name

Your Social Security Number

Enter

1

your

Spouse’s First Name and Middle Initial (if filing joint)

Last Name

Spouse’s Social Security No.

SSN(s).

1

Current Home Address - number and street, rural route

Apt. No.

Daytime Phone (with area code)

94

2

City, Town or Post Office

State

ZIP Code

REVENUE USE ONLY. DO NOT MARK IN THIS AREA.

88

3

1 Payment: You must round your estimated payment to a whole dollar (no cents).

$

00

Enter the amount of payment enclosed ...........................

81 PM

80 RCVD

2 Check only one box for the quarter for which this payment is made.

Do not select more than one quarter.

You must submit a separate form for each quarter for which a payment is made.

Payment for calendar year filers are due as follows:

|

Due date is April 15, 2015.

1st Quarter – January to March

|

Due date is June 15, 2015.

2nd Quarter – April to June

|

Due date is September 15, 2015.

3rd Quarter – July to September

|

4th Quarter – October to December

Due date is January 15, 2016.

Payment for fiscal year filers are due as follows:

1st Quarter – 15th day of the fourth month of the current fiscal year.

2nd Quarter – 15th day of the sixth month of the current fiscal year.

3rd Quarter – 15th day of the ninth month of the current fiscal year.

4th Quarter – 15th day of the first month of the next fiscal year.

If any of the due dates fall on a Saturday, Sunday or legal holiday, you may make

the required payment for that quarter by midnight on the next business day following that day.

IMPORTANT

To ensure proper application of this payment, be sure that you:

Complete and submit this form in its entirety. Do not cut this page in half.

Make your check payable to Arizona Department of Revenue.

Write your social security number and tax year on your payment.

Include your payment with Form 140ES.

Mail to Arizona Department of Revenue, PO Box 29085, Phoenix, AZ 85038-9085.

Be sure to review your estimated income and adjust your payments as necessary during the year.

Print Page

AZ Form 140ES (2015)

Page 1 of 2

ADOR 10575 (14)

1

1 2

2