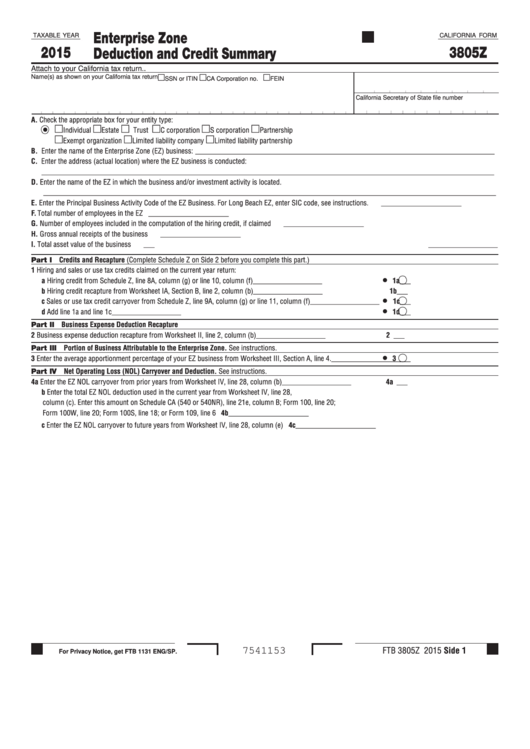

Enterprise Zone

TAXABLE YEAR

CALIFORNIA FORM

2015

3805Z

Deduction and Credit Summary

Attach to your California tax return.

.

Name(s) as shown on your California tax return

SSN or ITIN

CA Corporation no.

FEIN

California Secretary of State file number

A. Check the appropriate box for your entity type:

Individual

Estate

Trust

C corporation

S corporation

Partnership

Exempt organization

Limited liability company

Limited liability partnership

B. Enter the name of the Enterprise Zone (EZ) business: __________________________________________________________________________________

C. Enter the address (actual location) where the EZ business is conducted:

____________________________________________________________________________________________________________________________

D. Enter the name of the EZ in which the business and/or investment activity is located .

____________________________________________________________________________________________________________________________

E. Enter the Principal Business Activity Code of the EZ Business . For Long Beach EZ, enter SIC code, see instructions . . . . . . . . .

______________________

F. Total number of employees in the EZ . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

______________________

G. Number of employees included in the computation of the hiring credit, if claimed . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

______________________

H. Gross annual receipts of the business . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

______________________

I. Total asset value of the business . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

___

___________________

Part I Credits and Recapture (Complete Schedule Z on Side 2 before you complete this part .)

1 Hiring and sales or use tax credits claimed on the current year return:

a Hiring credit from Schedule Z, line 8A, column (g) or line 10, column (f) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

. . . .

1a___

___________________

b Hiring credit recapture from Worksheet IA, Section B, line 2, column (b) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

. . . . . . 1b___

___________________

c Sales or use tax credit carryover from Schedule Z, line 9A, column (g) or line 11, column (f) . . . . . . . . . . . . . . . . .

. . . .

1c___

___________________

d Add line 1a and line 1c . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

. . . .

1d___

___________________

Part II Business Expense Deduction Recapture

2 Business expense deduction recapture from Worksheet II, line 2, column (b) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

. . . . . . 2 ___

___________________

Part III Portion of Business Attributable to the Enterprise Zone. See instructions .

3 Enter the average apportionment percentage of your EZ business from Worksheet III, Section A, line 4 . . . . . . . . . . . . .

. . . .

3 ___

___________________

Part IV Net Operating Loss (NOL) Carryover and Deduction. See instructions .

4 a Enter the EZ NOL carryover from prior years from Worksheet IV, line 28, column (b) . . . . . . . . . . . . . . . . . . . . . . .

. . . . . . 4a ___

___________________

b Enter the total EZ NOL deduction used in the current year from Worksheet IV, line 28,

column (c) . Enter this amount on Schedule CA (540 or 540NR), line 21e, column B; Form 100, line 20;

Form 100W, line 20; Form 100S, line 18; or Form 109, line 6 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4b______________________

c Enter the EZ NOL carryover to future years from Worksheet IV, line 28, column (e) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4c______________________

FTB 3805Z 2015 Side 1

7541153

For Privacy Notice, get FTB 1131 ENG/SP.

1

1 2

2