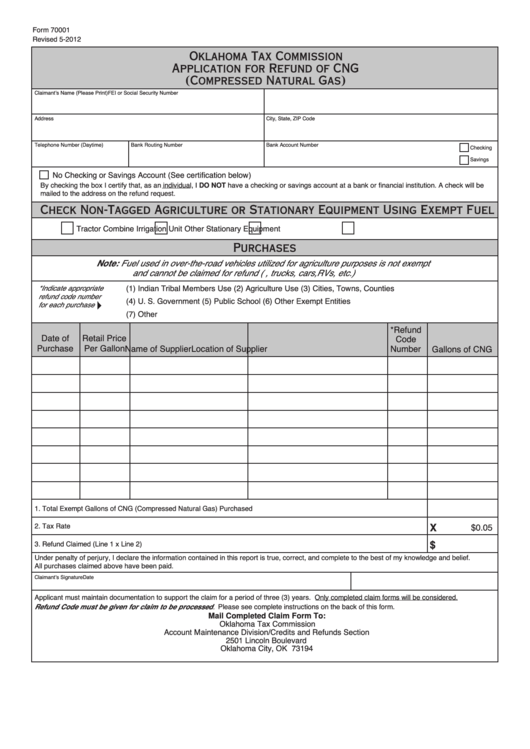

Form 70001

Revised 5-2012

Oklahoma Tax Commission

Application for Refund of CNG

(Compressed Natural Gas)

Claimant’s Name (Please Print)

FEI or Social Security Number

Address

City, State, ZIP Code

Telephone Number (Daytime)

Bank Routing Number

Bank Account Number

Checking

Savings

No Checking or Savings Account (See certification below)

By checking the box I certify that, as an individual, I DO NOT have a checking or savings account at a bank or financial institution. A check will be

mailed to the address on the refund request.

Check Non-Tagged Agriculture or Stationary Equipment Using Exempt Fuel

Tractor

Combine

Irrigation Unit

Other Stationary Equipment

Purchases

Note: Fuel used in over-the-road vehicles utilized for agriculture purposes is not exempt

and cannot be claimed for refund (i.e. pickups, trucks, cars,RVs, etc.)

*Indicate appropriate

(1) Indian Tribal Members Use

(2) Agriculture Use

(3) Cities, Towns, Counties

refund code number

(4) U. S. Government

(5) Public School

(6) Other Exempt Entities

for each purchase

(7) Other

*Refund

Date of

Retail Price

Code

Purchase

Per Gallon

Name of Supplier

Location of Supplier

Number

Gallons of CNG

1. Total Exempt Gallons of CNG (Compressed Natural Gas) Purchased .......................................................................................

2. Tax Rate ......................................................................................................................................................................................

$0.05

X

3. Refund Claimed (Line 1 x Line 2) ...............................................................................................................................................

$

Under penalty of perjury, I declare the information contained in this report is true, correct, and complete to the best of my knowledge and belief.

All purchases claimed above have been paid.

Claimant’s Signature

Date

Applicant must maintain documentation to support the claim for a period of three (3) years. Only completed claim forms will be considered.

Please see complete instructions on the back of this form.

Refund Code must be given for claim to be processed.

Mail Completed Claim Form To:

Oklahoma Tax Commission

Account Maintenance Division/Credits and Refunds Section

2501 Lincoln Boulevard

Oklahoma City, OK 73194

1

1 2

2