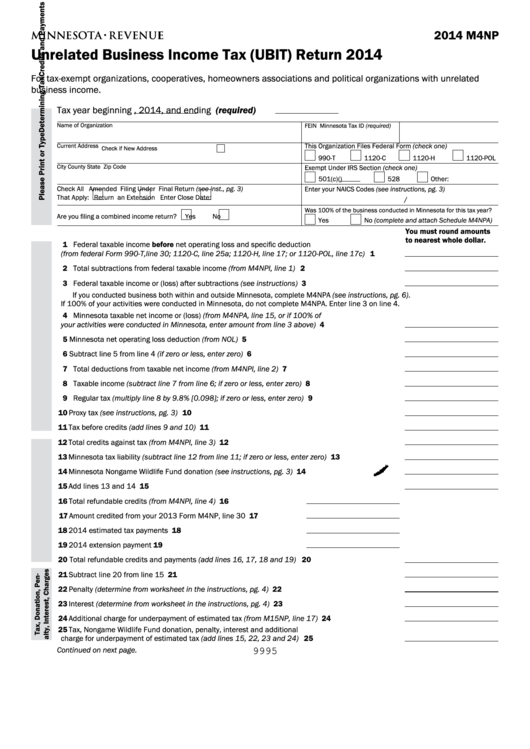

2014 M4NP

Unrelated Business Income Tax (UBIT) Return 2014

For tax-exempt organizations, cooperatives, homeowners associations and political organizations with unrelated

business income.

(required)

Tax year beginning

, 2014, and ending

Name of Organization

FEIN

Minnesota Tax ID (required)

This Organization Files Federal Form (check one)

Current Address

Check if New Address

990-T

1120-C

1120-H

1120-POL

City

County

State

Zip Code

Exempt Under IRS Section (check one)

501(c)(

)

528

Other:

Check All

Amended

Filing Under

Final Return (see inst., pg. 3)

Enter your NAICS Codes (see instructions, pg. 3)

That Apply:

Return

an Extension

Enter Close Date:

/

Was 100% of the business conducted in Minnesota for this tax year?

Are you filing a combined income return?

Yes

No

Yes

No (complete and attach Schedule M4NPA)

You must round amounts

to nearest whole dollar.

1 Federal taxable income before net operating loss and specific deduction

(from federal Form 990-T, line 30; 1120-C, line 25a; 1120-H, line 17; or 1120-POL, line 17c) . . . . 1

2 Total subtractions from federal taxable income (from M4NPI, line 1) . . . . . . . . . . . . . . . . . . . . . . . . . 2

3 Federal taxable income or (loss) after subtractions (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . 3

If you conducted business both within and outside Minnesota, complete M4NPA (see instructions, pg. 6) .

If 100% of your activities were conducted in Minnesota, do not complete M4NPA. Enter line 3 on line 4.

4 Minnesota taxable net income or (loss) (from M4NPA, line 15, or if 100% of

your activities were conducted in Minnesota, enter amount from line 3 above) . . . . . . . . . . . . . . . . 4

5 Minnesota net operating loss deduction (from NOL) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

6 Subtract line 5 from line 4 (if zero or less, enter zero) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

7 Total deductions from taxable net income (from M4NPI, line 2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

8 Taxable income (subtract line 7 from line 6; if zero or less, enter zero) . . . . . . . . . . . . . . . . . . . . . . . 8

9 Regular tax (multiply line 8 by 9.8% [0.098]; if zero or less, enter zero) . . . . . . . . . . . . . . . . . . . . . . . 9

10 Proxy tax (see instructions, pg. 3) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

11 Tax before credits (add lines 9 and 10) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

12 Total credits against tax (from M4NPI, line 3) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

13 Minnesota tax liability (subtract line 12 from line 11; if zero or less, enter zero) . . . . . . . . . . . . . . . 13

14 Minnesota Nongame Wildlife Fund donation (see instructions, pg. 3) . . . . . . . . . . . . . . . . . . .

14

15 Add lines 13 and 14 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15

16 Total refundable credits (from M4NPI, line 4) . . . . . . . . . . . . . . . . . 16

17 Amount credited from your 2013 Form M4NP, line 30 . . . . . . . . . . 17

18 2014 estimated tax payments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18

19 2014 extension payment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19

20 Total refundable credits and payments (add lines 16, 17, 18 and 19) . . . . . . . . . . . . . . . . . . . . . . . 20

21 Subtract line 20 from line 15 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 21

22 Penalty (determine from worksheet in the instructions, pg. 4) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 22

23 Interest (determine from worksheet in the instructions, pg. 4) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 23

24 Additional charge for underpayment of estimated tax (from M15NP, line 17) . . . . . . . . . . . . . . . . . 24

25 Tax, Nongame Wildlife Fund donation, penalty, interest and additional

charge for underpayment of estimated tax (add lines 15, 22, 23 and 24) . . . . . . . . . . . . . . . . . . . . 25

Continued on next page.

9995

1

1 2

2 3

3 4

4