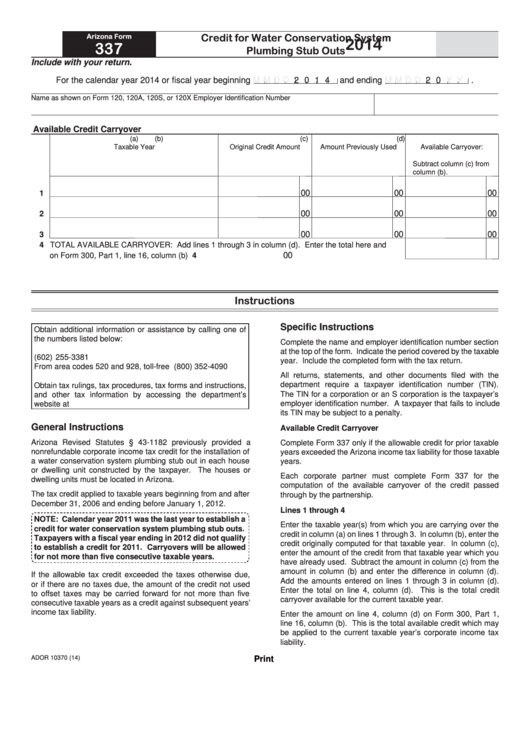

Credit for Water Conservation System

Arizona Form

2014

337

Plumbing Stub Outs

Include with your return.

For the calendar year 2014 or fiscal year beginning

M M D D

2 0 1 4 and ending

M M D D

2 0

Y Y

.

Name as shown on Form 120, 120A, 120S, or 120X

Employer Identification Number

Available Credit Carryover

(a)

(b)

(c)

(d)

Taxable Year

Original Credit Amount

Amount Previously Used

Available Carryover:

Subtract column (c) from

column (b).

00

00

00

1

00

00

00

2

00

00

00

3

4 TOTAL AVAILABLE CARRYOVER: Add lines 1 through 3 in column (d). Enter the total here and

00

on Form 300, Part 1, line 16, column (b) ...........................................................................................

4

Instructions

Specific Instructions

Obtain additional information or assistance by calling one of

the numbers listed below:

Complete the name and employer identification number section

at the top of the form. Indicate the period covered by the taxable

Phoenix........................................................... (602) 255-3381

year. Include the completed form with the tax return.

From area codes 520 and 928, toll-free ......... (800) 352-4090

All returns, statements, and other documents filed with the

department require a taxpayer identification number (TIN).

Obtain tax rulings, tax procedures, tax forms and instructions,

The TIN for a corporation or an S corporation is the taxpayer’s

and other tax information by accessing the department’s

employer identification number. A taxpayer that fails to include

website at

its TIN may be subject to a penalty.

General Instructions

Available Credit Carryover

Arizona Revised Statutes § 43-1182 previously provided a

Complete Form 337 only if the allowable credit for prior taxable

nonrefundable corporate income tax credit for the installation of

years exceeded the Arizona income tax liability for those taxable

a water conservation system plumbing stub out in each house

years.

or dwelling unit constructed by the taxpayer. The houses or

Each corporate partner must complete Form 337 for the

dwelling units must be located in Arizona.

computation of the available carryover of the credit passed

The tax credit applied to taxable years beginning from and after

through by the partnership.

December 31, 2006 and ending before January 1, 2012.

Lines 1 through 4

NOTE: Calendar year 2011 was the last year to establish a

Enter the taxable year(s) from which you are carrying over the

credit for water conservation system plumbing stub outs.

credit in column (a) on lines 1 through 3. In column (b), enter the

Taxpayers with a fiscal year ending in 2012 did not qualify

credit originally computed for that taxable year. In column (c),

to establish a credit for 2011. Carryovers will be allowed

enter the amount of the credit from that taxable year which you

for not more than five consecutive taxable years.

have already used. Subtract the amount in column (c) from the

amount in column (b) and enter the difference in column (d).

If the allowable tax credit exceeded the taxes otherwise due,

Add the amounts entered on lines 1 through 3 in column (d).

or if there are no taxes due, the amount of the credit not used

Enter the total on line 4, column (d). This is the total credit

to offset taxes may be carried forward for not more than five

carryover available for the current taxable year.

consecutive taxable years as a credit against subsequent years’

income tax liability.

Enter the amount on line 4, column (d) on Form 300, Part 1,

line 16, column (b). This is the total available credit which may

be applied to the current taxable year’s corporate income tax

liability.

ADOR 10370 (14)

Print

1

1