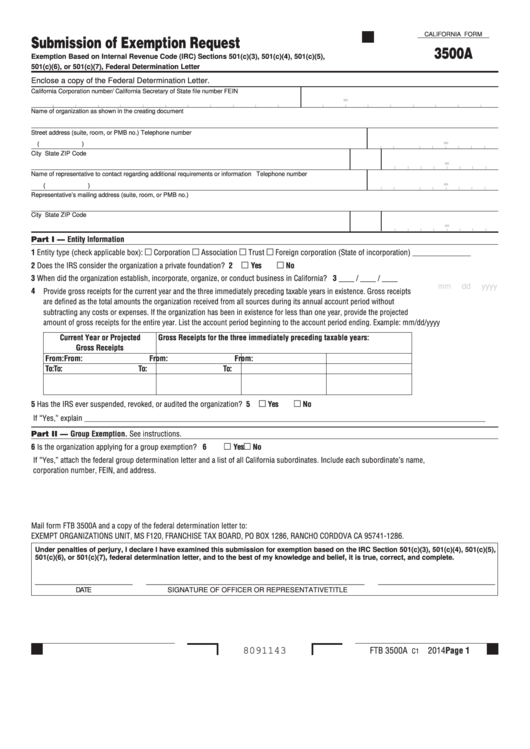

Form 3500a - California Submission Of Exemption Request

ADVERTISEMENT

CALIFORNIA FORM

Submission of Exemption Request

3500A

Exemption Based on Internal Revenue Code (IRC) Sections 501(c)(3), 501(c)(4), 501(c)(5),

501(c)(6), or 501(c)(7), Federal Determination Letter

Enclose a copy of the Federal Determination Letter.

California Corporation number/ California Secretary of State file number

FEIN

-

Name of organization as shown in the creating document

Street address (suite, room, or PMB no.)

Telephone number

-

(

)

City

State

ZIP Code

-

Name of representative to contact regarding additional requirements or information

Telephone number

-

(

)

Representative’s mailing address (suite, room, or PMB no.)

City

State

ZIP Code

-

Part I — Entity Information

m

m

m

m

1

Entity type (check applicable box):

Corporation

Association

Trust

Foreign corporation (State of incorporation) _______________

m

m

2

Does the IRS consider the organization a private foundation? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

Yes

No

3

When did the organization establish, incorporate, organize, or conduct business in California? . . . . . . . . . . . . . . . . . . . . . . . 3

____ / ____ / ____

mm

dd

yyyy

4

Provide gross receipts for the current year and the three immediately preceding taxable years in existence . Gross receipts

are defined as the total amounts the organization received from all sources during its annual account period without

subtracting any costs or expenses . If the organization has been in existence for less than one year, provide the projected

amount of gross receipts for the entire year . List the account period beginning to the account period ending . Example: mm/dd/yyyy

Current Year or Projected

Gross Receipts for the three immediately preceding taxable years:

Gross Receipts

From:

From:

From:

From:

To:

To:

To:

To:

m

m

5

Has the IRS ever suspended, revoked, or audited the organization? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

Yes

No

If “Yes,” explain _______________________________________________________________________________________________________

Part II — Group Exemption. See instructions .

m

m

6

Is the organization applying for a group exemption? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

Yes

No

If “Yes,” attach the federal group determination letter and a list of all California subordinates . Include each subordinate’s name,

corporation number, FEIN, and address .

Mail form FTB 3500A and a copy of the federal determination letter to:

EXEMPT ORGANIZATIONS UNIT, MS F120, FRANCHISE TAX BOARD, PO BOX 1286, RANCHO CORDOVA CA 95741-1286 .

Under penalties of perjury, I declare I have examined this submission for exemption based on the IRC Section 501(c)(3), 501(c)(4), 501(c)(5),

501(c)(6), or 501(c)(7), federal determination letter, and to the best of my knowledge and belief, it is true, correct, and complete.

_________________________

________________________________________________________

______________________________

DATE

SIGNATURE OF OFFICER OR REPRESENTATIVE

TITLE

FTB 3500A

2014 Page 1

8091143

C1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5