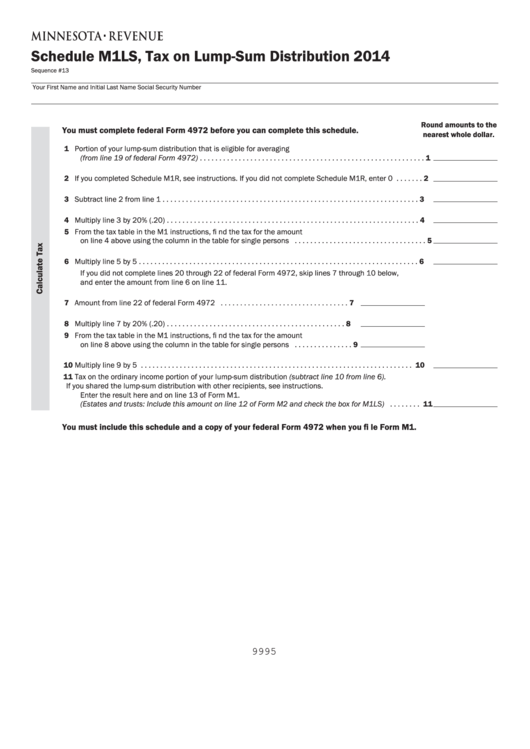

Schedule M1LS, Tax on Lump-Sum Distribution 2014

Sequence #13

Your First Name and Initial

Last Name

Social Security Number

Round amounts to the

You must complete federal Form 4972 before you can complete this schedule.

nearest whole dollar.

1 Portion of your lump-sum distribution that is eligible for averaging

(from line 19 of federal Form 4972) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

2 If you completed Schedule M1R, see instructions. If you did not complete Schedule M1R, enter 0 . . . . . . . 2

3 Subtract line 2 from line 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

4 Multiply line 3 by 20% (.20) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

5 From the tax table in the M1 instructions, fi nd the tax for the amount

on line 4 above using the column in the table for single persons . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

6 Multiply line 5 by 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

If you did not complete lines 20 through 22 of federal Form 4972, skip lines 7 through 10 below,

and enter the amount from line 6 on line 11.

7 Amount from line 22 of federal Form 4972 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

8 Multiply line 7 by 20% (.20) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

9 From the tax table in the M1 instructions, fi nd the tax for the amount

on line 8 above using the column in the table for single persons . . . . . . . . . . . . . . . 9

10 Multiply line 9 by 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

11 Tax on the ordinary income portion of your lump-sum distribution (subtract line 10 from line 6).

If you shared the lump-sum distribution with other recipients, see instructions.

Enter the result here and on line 13 of Form M1.

(Estates and trusts: Include this amount on line 12 of Form M2 and check the box for M1LS) . . . . . . . . 11

You must include this schedule and a copy of your federal Form 4972 when you fi le Form M1.

9995

1

1 2

2