RESET

PRINT

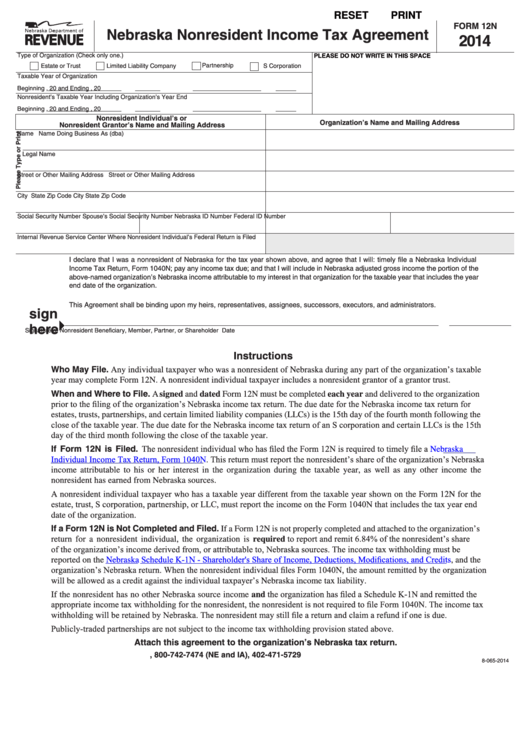

FORM 12N

Nebraska Nonresident Income Tax Agreement

2014

Type of Organization (Check only one.)

PLEASE DO NOT WRITE IN THIS SPACE

Estate or Trust

Partnership

Limited Liability Company

S Corporation

Taxable Year of Organization

Beginning

, 20

and Ending

, 20

Nonresident’s Taxable Year Including Organization’s Year End

Beginning

, 20

and Ending

, 20

Nonresident Individual’s or

Organization’s Name and Mailing Address

Nonresident Grantor’s Name and Mailing Address

Name

Name Doing Business As (dba)

Legal Name

Street or Other Mailing Address

Street or Other Mailing Address

City

State

Zip Code

City

State

Zip Code

Social Security Number

Spouse’s Social Security Number

Nebraska ID Number

Federal ID Number

Internal Revenue Service Center Where Nonresident Individual’s Federal Return is Filed

I declare that I was a nonresident of Nebraska for the tax year shown above, and agree that I will: timely file a Nebraska Individual

Income Tax Return, Form 1040N; pay any income tax due; and that I will include in Nebraska adjusted gross income the portion of the

above-named organization’s Nebraska income attributable to my interest in that organization for the taxable year that includes the year

end date of the organization.

This Agreement shall be binding upon my heirs, representatives, assignees, successors, executors, and administrators.

sign

here

Signature of Nonresident Beneficiary, Member, Partner, or Shareholder

Date

Instructions

Who May File. Any individual taxpayer who was a nonresident of Nebraska during any part of the organization’s taxable

year may complete Form 12N. A nonresident individual taxpayer includes a nonresident grantor of a grantor trust.

When and Where to File. A signed and dated Form 12N must be completed each year and delivered to the organization

prior to the filing of the organization’s Nebraska income tax return. The due date for the Nebraska income tax return for

estates, trusts, partnerships, and certain limited liability companies (LLCs) is the 15th day of the fourth month following the

close of the taxable year. The due date for the Nebraska income tax return of an S corporation and certain LLCs is the 15th

day of the third month following the close of the taxable year.

If Form 12N is Filed. The nonresident individual who has filed the Form 12N is required to timely file a

Nebraska

Individual Income Tax Return, Form

1040N. This return must report the nonresident’s share of the organization’s Nebraska

income attributable to his or her interest in the organization during the taxable year, as well as any other income the

nonresident has earned from Nebraska sources.

A nonresident individual taxpayer who has a taxable year different from the taxable year shown on the Form 12N for the

estate, trust, S corporation, partnership, or LLC, must report the income on the Form 1040N that includes the tax year end

date of the organization.

If a Form 12N is Not Completed and Filed. If a Form 12N is not properly completed and attached to the organization’s

return for a nonresident individual, the organization is required to report and remit 6.84% of the nonresident’s share

of the organization’s income derived from, or attributable to, Nebraska sources. The income tax withholding must be

Nebraska Schedule K-1N - Shareholder's Share of Income, Deductions, Modifications, and

Credits, and the

reported on the

organization’s Nebraska return. When the nonresident individual files Form 1040N, the amount remitted by the organization

will be allowed as a credit against the individual taxpayer’s Nebraska income tax liability.

If the nonresident has no other Nebraska source income and the organization has filed a Schedule K-1N and remitted the

appropriate income tax withholding for the nonresident, the nonresident is not required to file Form 1040N. The income tax

withholding will be retained by Nebraska. The nonresident may still file a return and claim a refund if one is due.

Publicly-traded partnerships are not subject to the income tax withholding provision stated above.

Attach this agreement to the organization’s Nebraska tax return.

revenue.nebraska.gov, 800-742-7474 (NE and IA), 402-471-5729

8-065-2014

1

1