2014 Instructions for Schedule H (100)

Dividend Income Deduction

Important Information

Specific Instructions

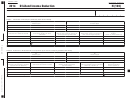

To complete Part II:

1. Fill in columns (a) through (c).

Revenue and Taxation Code (R&TC)

California follows the federal dividend

2. Enter in column (d) the total amount of

Section 24410 was repealed and re-enacted

distributions ordering rule where dividends

insurance dividends received.

to allow a “Dividends Received Deduction”

are deemed to be paid out of current year

3. Enter the qualified dividend percentage in

for qualified dividends received from an

E&P first, and then layered back on a last-in,

column (e).

insurer subsidiary. The deduction is allowed

first-out (LIFO) basis.

4. Multiply the amount in column (d) by the

whether or not the insurer is engaged in

qualified dividend percentage in column (e)

A corporation may eliminate or deduct dividend

business in California, if at the time of each

and enter that amount in column (f).

income when certain requirements are met.

payment, at least 80% of each class of stock

5. Multiply the amount in column (f) by 85%

The available eliminations or deductions are

of the insurer was owned by the corporation

and enter the result in column (g).

described below.

receiving the dividend. For taxable years

6. Total the amounts on Part II, line 4,

beginning on or after January 1, 2004, and

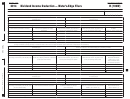

Part I – Elimination of

column (g). Enter the amount from Part II,

before January 1, 2008, an 80% deduction

Intercompany Dividends (R&TC

line 4, column (g) on Form 100, Side 1,

was allowed for qualified dividends. For taxable

line 11.

Section 25106)

years beginning on or after January 1, 2008,

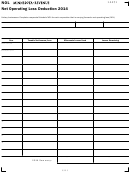

The calculation of the qualified dividend

the deduction is increased to 85%. A portion

A corporation may eliminate dividends received

percentage should be presented in a

of the dividends may not qualify if the

from unitary subsidiaries but only to the extent

supplemental schedule that is attached to

insurer subsidiary paying the dividend is

that the dividends are paid from unitary E&P

the taxpayer’s return. That schedule should

overcapitalized for the purpose of the dividends

accumulated while both the payee and payer

identify the amount of the net written

received deduction. See Specific Instructions,

were members of the combined report. See

premiums for all the insurance companies

Part II, for more information.

R&TC Section 25106 for more information.

in the commonly controlled group for the

For taxable years beginning on or after

Complete Part I and enter the total of Part I,

preceding five years (including an identification

January 1, 2008, dividend elimination is allowed

line 4, column (d) on Form 100, Side 1, line 10.

of property/casualty premiums, life insurance

regardless of whether the payer/payee are

premiums, and financial guarantee premiums),

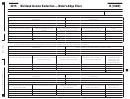

Part II – Deduction for Dividends

taxpayer members of the California combined

the relative weight given to each class of net

unitary group return, or whether the payer/

Paid to a Corporation by an

written premiums, and the total income of

payee had previously filed California tax returns,

the insurance companies in the commonly

Insurance Company (R&TC

as long as the payer/payee filed as members

controlled group (including premium and

Section 24410)

of a comparable unitary business outside of

investment income for the preceding five

California when the earnings and profits (E&P)

R&TC Section 24410 provides that a

years). For more information, see R&TC

from which the dividends were paid arose.

Section 24410.

corporation that owns 80% or more of

In addition, dividend elimination is allowed

each class of stock of an insurer is entitled

for dividends paid from a member of a

to 85% dividends received deduction for

combined unitary group to a newly formed

qualified dividends received from that

member of the combined unitary group if the

insurer. The deduction would be allowed

recipient corporation has been a member of

regardless of whether the insurer does

the combined unitary group from its formation

business in California. The 85% deduction

to its receipt of the dividends. E&P earned

applies to taxable years beginning on or after

before becoming a member of the unitary

January 1, 2008.

group do not qualify for elimination. See R&TC

The amount of the dividends that qualify for

Section 25106 for more information.

the dividends received deduction is the total

In Farmer Bros. Co. v. Franchise Tax Board (2003)

amount of dividends received from that insurer,

108 Cal App 4th 976, 134 Cal Rptr. 2nd 390,

multiplied by the insurer’s qualified dividend

the California Court of Appeal found R&TC

percentage. The qualified dividend percentage

Section 24402 to be unconstitutional. A statute

is determined under R&TC Section 24410(c).

that is held to be unconstitutional is invalid and

unenforceable. Therefore, R&TC Section 24402

deduction is not available.

Page 28 Form 100 Booklet 2014

1

1 2

2