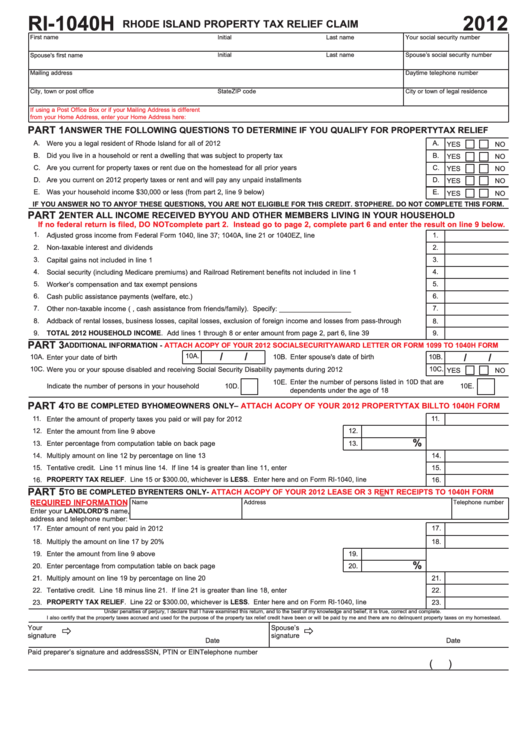

RI-1040H

2012

RHODE ISLAND PROPERTY TAX RELIEF CLAIM

First name

Initial

Last name

Your social security number

Initial

Last name

Spouse’s social security number

Spouse's first name

Mailing address

Daytime telephone number

City, town or post office

State

ZIP code

City or town of legal residence

If using a Post Office Box or if your Mailing Address is different

from your Home Address, enter your Home Address here:

PART 1

ANSWER THE FOLLOWING QUESTIONS TO DETERMINE IF YOU QUALIFY FOR PROPERTY TAX RELIEF

A.

Were you a legal resident of Rhode Island for all of 2012 .............................................................................................................

A.

YES

NO

B.

Did you live in a household or rent a dwelling that was subject to property tax ............................................................................

B.

YES

NO

C.

Are you current for property taxes or rent due on the homestead for all prior years .....................................................................

C.

YES

NO

D.

Are you current on 2012 property taxes or rent and will pay any unpaid installments ..................................................................

D.

YES

NO

E.

Was your household income $30,000 or less (from part 2, line 9 below) ......................................................................................

E.

YES

NO

IF YOU ANSWER NO TO ANY OF THESE QUESTIONS, YOU ARE NOT ELIGIBLE FOR THIS CREDIT. STOP HERE. DO NOT COMPLETE THIS FORM.

PART 2

ENTER ALL INCOME RECEIVED BY YOU AND OTHER MEMBERS LIVING IN YOUR HOUSEHOLD

If no federal return is filed, DO NOT complete part 2. Instead go to page 2, complete part 6 and enter the result on line 9 below.

1.

Adjusted gross income from Federal Form 1040, line 37; 1040A, line 21 or 1040EZ, line 4.........................................................

1.

2.

2.

Non-taxable interest and dividends ................................................................................................................................................

3.

Capital gains not included in line 1 .................................................................................................................................................

3.

4.

Social security (including Medicare premiums) and Railroad Retirement benefits not included in line 1 .....................................

4.

5.

5.

Worker’s compensation and tax exempt pensions .........................................................................................................................

6.

Cash public assistance payments (welfare, etc.) ...........................................................................................................................

6.

7.

Other non-taxable income (e.g. child support received, cash assistance from friends/family). Specify: ___________________

7.

8.

Addback of rental losses, business losses, capital losses, exclusion of foreign income and losses from pass-through entity......

8.

9.

TOTAL 2012 HOUSEHOLD INCOME. Add lines 1 through 8 or enter amount from page 2, part 6, line 39 ...............................

9.

PART 3

ADDITIONAL INFORMATION -

ATTACH A COPY OF YOUR 2012 SOCIAL SECURITY AWARD LETTER OR FORM 1099 TO 1040H FORM

10A.

/

/

/

/

10A.

Enter your date of birth ................................

10B.

Enter spouse's date of birth ...........................

10B.

10C.

Were you or your spouse disabled and receiving Social Security Disability payments during 2012 .............................................

10C.

YES

NO

10E.

Enter the number of persons listed in 10D that are

10D.

Indicate the number of persons in your household ............

10D.

10E.

dependents under the age of 18 ...................................

PART 4

TO BE COMPLETED BY HOMEOWNERS ONLY–

ATTACH A COPY OF YOUR 2012 PROPERTY TAX BILL TO 1040H FORM

11.

Enter the amount of property taxes you paid or will pay for 2012 ..................................................................................................

11.

12.

Enter the amount from line 9 above ...................................................................................................

12.

%

13.

Enter percentage from computation table on back page ...................................................................

13.

14.

Multiply amount on line 12 by percentage on line 13 .....................................................................................................................

14.

15.

15.

Tentative credit. Line 11 minus line 14. If line 14 is greater than line 11, enter zero....................................................................

16.

PROPERTY TAX RELIEF. Line 15 or $300.00, whichever is LESS. Enter here and on Form RI-1040, line 14C.........................

16.

PART 5

TO BE COMPLETED BY RENTERS ONLY -

ATTACH A COPY OF YOUR 2012 LEASE OR 3 RENT RECEIPTS TO 1040H FORM

REQUIRED INFORMATION

Name

Address

Telephone number

Enter your LANDLORD’S name,

address and telephone number:

17.

Enter amount of rent you paid in 2012 ...........................................................................................................................................

17.

18.

Multiply the amount on line 17 by 20% ..........................................................................................................................................

18.

19.

Enter the amount from line 9 above ...................................................................................................

19.

%

20.

20.

Enter percentage from computation table on back page ...................................................................

21.

Multiply amount on line 19 by percentage on line 20 .....................................................................................................................

21.

22.

Tentative credit. Line 18 minus line 21. If line 21 is greater than line 18, enter zero....................................................................

22.

23.

PROPERTY TAX RELIEF. Line 22 or $300.00, whichever is LESS. Enter here and on Form RI-1040, line 14C.........................

23.

Under penalties of perjury, I declare that I have examined this return, and to the best of my knowledge and belief, it is true, correct and complete.

I also certify that the property taxes accrued and used for the purpose of the property tax relief credit have been or will be paid by me and there are no delinquent property taxes on my homestead.

Your

Spouse’s

signature

signature

Date

Date

Paid preparer’s signature and address

SSN, PTIN or EIN

Telephone number

(

)

1

1 2

2