Form Ri-1040es - State Of Rhode Island Estimated Payment Coupon - 2013

ADVERTISEMENT

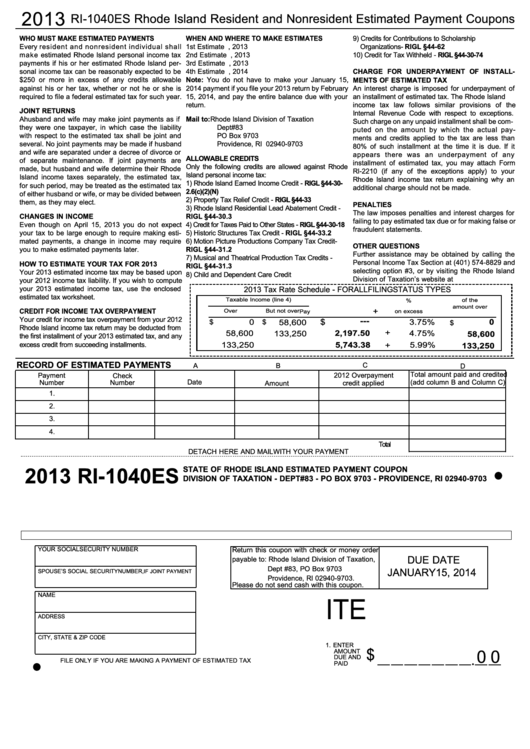

2013

RI-1040ES Rhode Island Resident and Nonresident Estimated Payment Coupons

WHO MUST MAKE ESTIMATED PAYMENTS

WHEN AND WHERE TO MAKE ESTIMATES

9) Credits for Contributions to Scholarship

Every resident and nonresident individual shall

1st Estimate Due......................April 15, 2013

Organizations - RIGL §44-62

make estimated Rhode Island personal income tax

2nd Estimate Due.....................June 15, 2013

10) Credit for Tax Withheld - RIGL §44-30-74

payments if his or her estimated Rhode Island per-

3rd Estimate Due.....................September 15, 2013

sonal income tax can be reasonably expected to be

4th Estimate Due.....................January 15, 2014

CHARGE FOR UNDERPAYMENT OF INSTALL-

$250 or more in excess of any credits allowable

Note: You do not have to make your January 15,

MENTS OF ESTIMATED TAX

against his or her tax, whether or not he or she is

2014 payment if you file your 2013 return by February

An interest charge is imposed for underpayment of

required to file a federal estimated tax for such year.

15, 2014, and pay the entire balance due with your

an installment of estimated tax. The Rhode Island

return.

income tax law follows similar provisions of the

JOINT RETURNS

Internal Revenue Code with respect to exceptions.

A husband and wife may make joint payments as if

Mail to: Rhode Island Division of Taxation

Such charge on any unpaid installment shall be com-

they were one taxpayer, in which case the liability

Dept#83

puted on the amount by which the actual pay-

with respect to the estimated tax shall be joint and

PO Box 9703

ments and credits applied to the tax are less than

several. No joint payments may be made if husband

Providence, RI 02940-9703

80% of such installment at the time it is due. If it

and wife are separated under a decree of divorce or

appears there was an underpayment of any

ALLOWABLE CREDITS

of separate maintenance. If joint payments are

installment of estimated tax, you may attach Form

Only the following credits are allowed against Rhode

made, but husband and wife determine their Rhode

RI-2210 (if any of the exceptions apply) to your

Island personal income tax:

Island income taxes separately, the estimated tax,

Rhode Island income tax return explaining why an

1) Rhode Island Earned Income Credit - RIGL §44-30-

for such period, may be treated as the estimated tax

additional charge should not be made.

2.6(c)(2)(N)

of either husband or wife, or may be divided between

2) Property Tax Relief Credit - RIGL §44-33

them, as they may elect.

PENALTIES

3) Rhode Island Residential Lead Abatement Credit -

The law imposes penalties and interest charges for

CHANGES IN INCOME

RIGL §44-30.3

failing to pay estimated tax due or for making false or

Even though on April 15, 2013 you do not expect

4) Credit for Taxes Paid to Other States - RIGL §44-30-18

fraudulent statements.

your tax to be large enough to require making esti-

5) Historic Structures Tax Credit - RIGL §44-33.2

mated payments, a change in income may require

6) Motion Picture Productions Company Tax Credit -

OTHER QUESTIONS

you to make estimated payments later.

RIGL §44-31.2

Further assistance may be obtained by calling the

7) Musical and Theatrical Production Tax Credits -

Personal Income Tax Section at (401) 574-8829 and

HOW TO ESTIMATE YOUR TAX FOR 2013

RIGL §44-31.3

selecting option #3, or by visiting the Rhode Island

Your 2013 estimated income tax may be based upon

8) Child and Dependent Care Credit

Division of Taxation’s website at

your 2012 income tax liability. If you wish to compute

your 2013 estimated income tax, use the enclosed

2013 Tax Rate Schedule - FOR ALL FILING STATUS TYPES

estimated tax worksheet.

Taxable Income (line 4)

of the

%

amount over

+

CREDIT FOR INCOME TAX OVERPAYMENT

Over

But not over

Pay

on excess

Your credit for income tax overpayment from your 2012

---

0

$

3.75%

0

$

$

58,600

$

Rhode Island income tax return may be deducted from

+

58,600

133,250

2,197.50

4.75%

58,600

the first installment of your 2013 estimated tax, and any

excess credit from succeeding installments.

133,250

..........

5,743.38

+

5.99%

133,250

RECORD OF ESTIMATED PAYMENTS

C

A

B

D

Total amount paid and credited

Payment

Check

2012 Overpayment

Date

(add column B and Column C)

Number

Number

Amount

credit applied

1.

2.

3.

4.

Total

DETACH HERE AND MAIL WITH YOUR PAYMENT

STATE OF RHODE ISLAND ESTIMATED PAYMENT COUPON

2013

RI-1040ES

DIVISION OF TAXATION - DEPT#83 - PO BOX 9703 - PROVIDENCE, RI 02940-9703

YOUR SOCIAL SECURITY NUMBER

Return this coupon with check or money order

DUE DATE

payable to: Rhode Island Division of Taxation,

Dept #83, PO Box 9703

SPOUSE’S SOCIAL SECURITY NUMBER,

JANUARY 15, 2014

IF JOINT PAYMENT

Providence, RI 02940-9703.

Please do not send cash with this coupon.

NAME

ITE

ADDRESS

CITY, STATE & ZIP CODE

1. ENTER

AMOUNT

$

0 0

DUE AND

FILE ONLY IF YOU ARE MAKING A PAYMENT OF ESTIMATED TAX

PAID

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3