Form Rev-414(P/s) Ex - Pa Nonresident Tax Withholding Worksheet For Partnerships And Pa S Corporations

ADVERTISEMENT

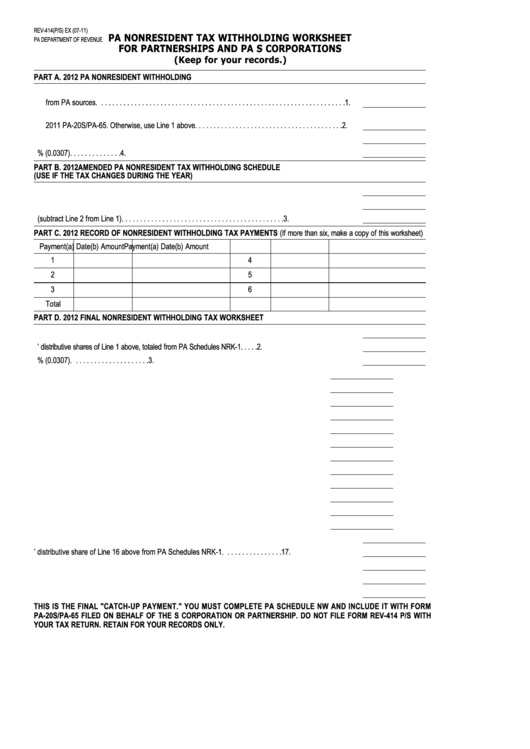

REV-414(P/S) EX (07-11)

PA NONRESIDENT TAX WITHHOLDING WORKSHEET

PA DEPARTMENT OF REVENUE

FOR PARTNERSHIPS AND PA S CORPORATIONS

(Keep for your records.)

PART A. 2012 PA NONRESIDENT WITHHOLDING

1. Enter the 2012 PA taxable income the partnership or PA S corporation expects to realize

from PA sources. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1.

2. Enter the 2011 PA taxable income the entity realized from PA sources and reported on its

2011 PA-20S/PA-65. Otherwise, use Line 1 above. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2.

3. Enter the smaller of Line 1 or Line 2. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3.

4. Nonresident PA source nonresident withholding. Multiply Line 3 by 3.07% (0.0307). . . . . . . . . . . . . . 4.

PART B. 2012 AMENDED PA NONRESIDENT TAX WITHHOLDING SCHEDULE

(USE IF THE TAX CHANGES DURING THE YEAR)

1. Amended nonresident withholding. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1.

2. Nonresident withholding payments made to date of amending. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2.

3. Unpaid balance (subtract Line 2 from Line 1). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3.

PART C. 2012 RECORD OF NONRESIDENT WITHHOLDING TAX PAYMENTS (If more than six, make a copy of this worksheet)

Payment

(a) Date

(b) Amount

Payment

(a) Date

(b) Amount

1

4

2

5

3

6

Total

PART D. 2012 FINAL NONRESIDENT WITHHOLDING TAX WORKSHEET

1. Enter the total PA taxable income from PA sources from the 2012 PA-20S/PA-65. . . . . . . . . . . . . . . . 1.

2. Enter the total nonresidents’ distributive shares of Line 1 above, totaled from PA Schedules NRK-1. . . . . 2.

3. Total 2012 PA Nonresident Withholding. Multiply Line 2 by 3.07% (0.0307). . . . . . . . . . . . . . . . . . . . . 3.

4. Allowable PA Employment Incentive Payments Credit. . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4.

5. Allowable PA Job Creation Tax Credit. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5.

6. Allowable PA Research and Development Tax Credit. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6.

7. Allowable PA Film Production Tax Credit. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7.

8. Allowable PA Organ and Bone Marrow Donor Tax Credit. . . . . . . . . . . . . . . . . . . . . . . . . . . 8.

9. Allowable PA Keystone Innovation Zone Tax Credit. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9.

10. Allowable PA Resource Enhancement and Protection Tax Credit. . . . . . . . . . . . . . . . . . . . . 10.

11. Allowable PA Neighborhood Assistance Program Tax Credit. . . . . . . . . . . . . . . . . . . . . . . . 11.

12. Allowable PA Strategic Development Area Job Creation Tax Credit. . . . . . . . . . . . . . . . . . . 12.

13. Allowable PA Educational Improvement Tax Credit. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13.

14. Allowable PA Keystone Special Development Zone Tax Credit. . . . . . . . . . . . . . . . . . . . . . 14.

15. Other PA Schedule OC Credit not listed above. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15.

16. Total Allowable Credits. Add Lines 4 through 15. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16.

17. The nonresidents’ distributive share of Line 16 above from PA Schedules NRK-1. . . . . . . . . . . . . . . . 17.

18. Total nonresident withholding paid for the taxable year. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18.

19. Total credits and withholding payments. Add Lines 16 and 18. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19.

20. Nonresident withholding due. Subtract Line 19 from Line 3. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20.

THIS IS THE FINAL "CATCH-UP PAYMENT." YOU MUST COMPLETE PA SCHEDULE NW AND INCLUDE IT WITH FORM

PA-20S/PA-65 FILED ON BEHALF OF THE S CORPORATION OR PARTNERSHIP. DO NOT FILE FORM REV-414 P/S WITH

YOUR TAX RETURN. RETAIN FOR YOUR RECORDS ONLY.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2