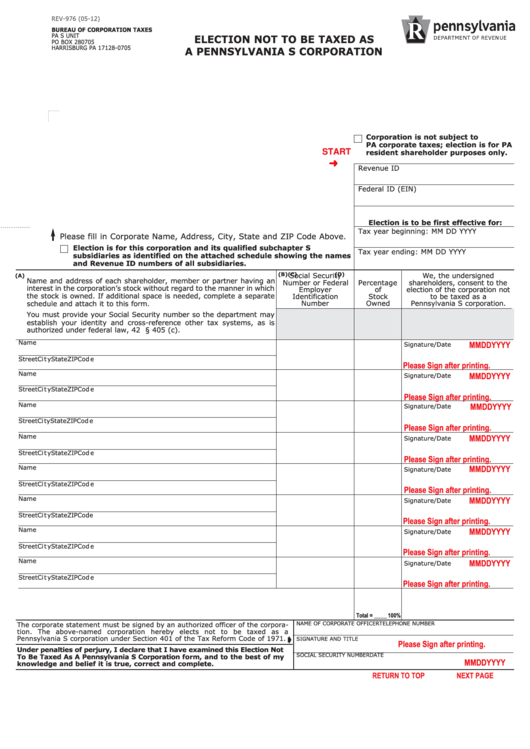

REV-976 (05-12)

BUREAU OF CORPORATION TAXES

PA S UNIT

ELECTION NOT TO BE TAXED AS

PO BOX 280705

HARRISBURG PA 17128-0705

A PENNSYLVANIA S CORPORATION

Corporation is not subject to

PA corporate taxes; election is for PA

START

resident shareholder purposes only.

Revenue ID

Federal ID (EIN)

Election is to be first effective for:

Tax year beginning:

MM DD YYYY

Please fill in Corporate Name, Address, City, State and ZIP Code Above.

Election is for this corporation and its qualified subchapter S

Tax year ending:

MM DD YYYY

subsidiaries as identified on the attached schedule showing the names

and Revenue ID numbers of all subsidiaries.

(B)

(C)

(D)

Social Security

We, the undersigned

(A)

Name and address of each shareholder, member or partner having an

Number or Federal

Percentage

shareholders, consent to the

interest in the corporation’s stock without regard to the manner in which

Employer

of

election of the corporation not

the stock is owned. If additional space is needed, complete a separate

Identification

Stock

to be taxed as a

schedule and attach it to this form.

Number

Owned

Pennsylvania S corporation.

You must provide your Social Security number so the department may

establish your identity and cross-reference other tax systems, as is

authorized under federal law, 42 U.S.C. § 405 (c).

MMDDYYYY

Name

Signature/Date

Street

Ci t y

State

ZIP Cod e

Please Sign after printing.

MMDDYYYY

Name

Signature/Date

Street

Ci t y

State

ZIP Cod e

Please Sign after printing.

MMDDYYYY

Name

Signature/Date

Street

Ci ty

State

ZIP Cod e

Please Sign after printing.

MMDDYYYY

Name

Signature/Date

Street

Ci t y

State

ZIP Cod e

Please Sign after printing.

MMDDYYYY

Name

Signature/Date

Street

Ci t y

State

ZIP Cod e

Please Sign after printing.

MMDDYYYY

Name

Signature/Date

Street

Ci t y

State

ZIP Code

Please Sign after printing.

MMDDYYYY

Name

Signature/Date

Street

Ci t y

State

ZIP Cod e

Please Sign after printing.

MMDDYYYY

Name

Signature/Date

Street

Ci t y

State

ZIP Cod e

Please Sign after printing.

Total = _____ 100%

NAME OF CORPORATE OFFICER

TELEPHONE NUMBER

The corporate statement must be signed by an authorized officer of the corpora-

tion. The above-named corporation hereby elects not to be taxed as a

Á

Pennsylvania S corporation under Section 401 of the Tax Reform Code of 1971.

SIGNATURE AND TITLE

Please Sign after printing.

Under penalties of perjury, I declare that I have examined this Election Not

SOCIAL SECURITY NUMBER

DATE

To Be Taxed As A Pennsylvania S Corporation form, and to the best of my

MMDDYYYY

knowledge and belief it is true, correct and complete.

Reset Entire Form

PRINT FORM

RETURN TO TOP

NEXT PAGE

1

1 2

2