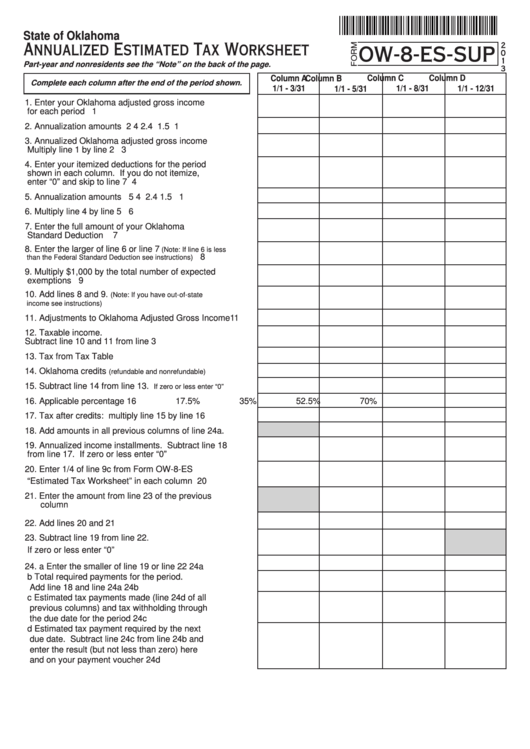

State of Oklahoma

Annualized Estimated Tax Worksheet

2

OW-8-ES-SUP

0

1

Part-year and nonresidents see the “Note” on the back of the page.

3

Column A

Column C

Column D

Column B

Complete each column after the end of the period shown.

1/1 - 3/31

1/1 - 8/31

1/1 - 12/31

1/1 - 5/31

1. Enter your Oklahoma adjusted gross income

for each period ......................................................... 1

2. Annualization amounts .............................................. 2

4

2.4

1.5

1

3. Annualized Oklahoma adjusted gross income

Multiply line 1 by line 2 ............................................. 3

4. Enter your itemized deductions for the period

shown in each column. If you do not itemize,

enter “0” and skip to line 7 ........................................ 4

5. Annualization amounts ............................................. 5

4

2.4

1.5

1

6. Multiply line 4 by line 5 ............................................. 6

7. Enter the full amount of your Oklahoma

Standard Deduction ................................................ 7

8. Enter the larger of line 6 or line 7

(Note: If line 6 is less

............ 8

than the Federal Standard Deduction see instructions)

9. Multiply $1,000 by the total number of expected

exemptions ............................................................... 9

10. Add lines 8 and 9.

(Note: If you have out-of-state

.................................................. 10

income see instructions)

11. Adjustments to Oklahoma Adjusted Gross Income ....11

12. Taxable income.

Subtract line 10 and 11 from line 3 ........................... 12

13. Tax from Tax Table ................................................... 13

14. Oklahoma credits

............. 14

(refundable and nonrefundable)

15. Subtract line 14 from line 13.

..... 15

If zero or less enter “0”

16. Applicable percentage ............................................. 16

17.5%

35%

52.5%

70%

17. Tax after credits: multiply line 15 by line 16 ............ 17

18. Add amounts in all previous columns of line 24a. .... 18

19. Annualized income installments. Subtract line 18

from line 17. If zero or less enter “0” ....................... 19

20. Enter 1/4 of line 9c from Form OW-8-ES

“Estimated Tax Worksheet” in each column ............ 20

21. Enter the amount from line 23 of the previous

column ..................................................................... 21

22. Add lines 20 and 21 .................................................. 22

23. Subtract line 19 from line 22.

If zero or less enter “0” ............................................. 23

24. a

Enter the smaller of line 19 or line 22 .............. 24a

b

Total required payments for the period.

Add line 18 and line 24a .................................. 24b

c

Estimated tax payments made (line 24d of all

previous columns) and tax withholding through

the due date for the period ............................... 24c

d

Estimated tax payment required by the next

due date. Subtract line 24c from line 24b and

enter the result (but not less than zero) here

and on your payment voucher ......................... 24d

1

1 2

2