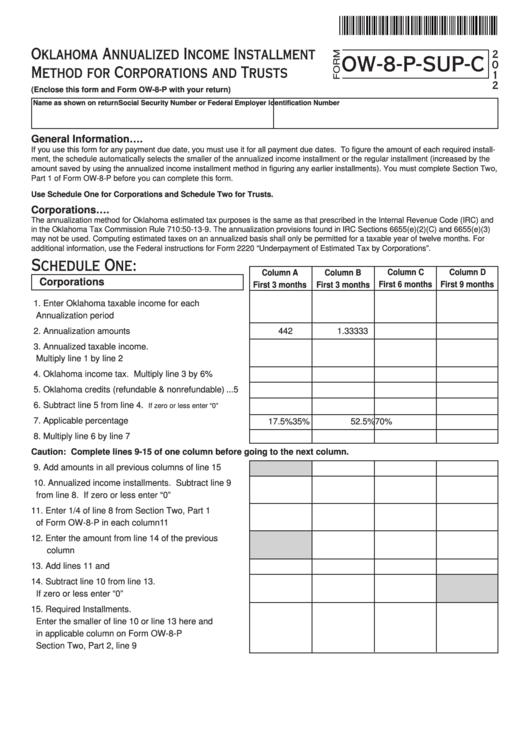

Oklahoma Annualized Income Installment

2

OW-8-P-SUP-C

0

Method for Corporations and Trusts

1

2

(Enclose this form and Form OW-8-P with your return)

Social Security Number or Federal Employer Identification Number

Name as shown on return

General Information….

If you use this form for any payment due date, you must use it for all payment due dates. To figure the amount of each required install-

ment, the schedule automatically selects the smaller of the annualized income installment or the regular installment (increased by the

amount saved by using the annualized income installment method in figuring any earlier installments). You must complete Section Two,

Part 1 of Form OW-8-P before you can complete this form.

Use Schedule One for Corporations and Schedule Two for Trusts.

Corporations….

The annualization method for Oklahoma estimated tax purposes is the same as that prescribed in the Internal Revenue Code (IRC) and

in the Oklahoma Tax Commission Rule 710:50-13-9. The annualization provisions found in IRC Sections 6655(e)(2)(C) and 6655(e)(3)

may not be used. Computing estimated taxes on an annualized basis shall only be permitted for a taxable year of twelve months. For

additional information, use the Federal instructions for Form 2220 “Underpayment of Estimated Tax by Corporations”.

Schedule One:

Column C

Column D

Column A

Column B

Corporations

First 6 months

First 9 months

First 3 months

First 3 months

1. Enter Oklahoma taxable income for each

Annualization period .............................................. 1

2. Annualization amounts ........................................... 2

4

4

2

1.33333

3. Annualized taxable income.

Multiply line 1 by line 2 ........................................... 3

4. Oklahoma income tax. Multiply line 3 by 6% ........ 4

5. Oklahoma credits (refundable & nonrefundable) ... 5

6. Subtract line 5 from line 4.

...... 6

If zero or less enter “0”

7. Applicable percentage ........................................... 7

17.5%

35%

52.5%

70%

8. Multiply line 6 by line 7 ........................................... 8

Caution: Complete lines 9-15 of one column before going to the next column.

9. Add amounts in all previous columns of line 15 ..... 9

10. Annualized income installments. Subtract line 9

from line 8. If zero or less enter “0” ..................... 10

11. Enter 1/4 of line 8 from Section Two, Part 1

of Form OW-8-P in each column .......................... 11

12. Enter the amount from line 14 of the previous

column ................................................................. 12

13. Add lines 11 and 12.............................................. 13

14. Subtract line 10 from line 13.

If zero or less enter “0” ......................................... 14

15. Required Installments.

Enter the smaller of line 10 or line 13 here and

in applicable column on Form OW-8-P

Section Two, Part 2, line 9 ................................... 15

1

1 2

2