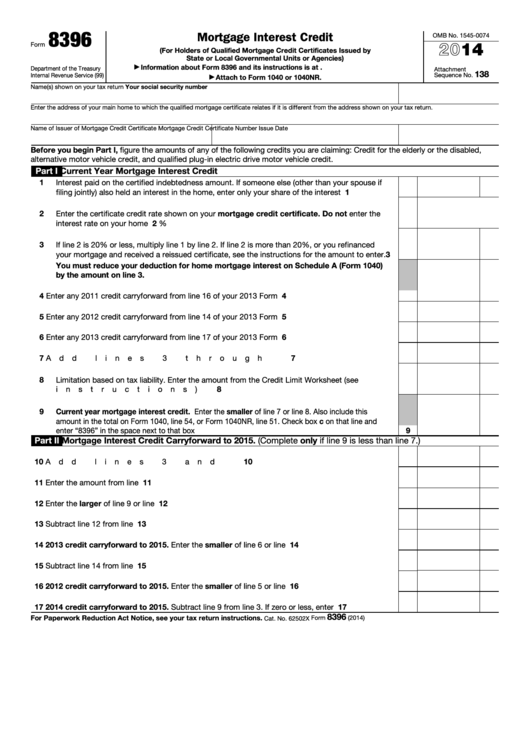

8396

Mortgage Interest Credit

OMB No. 1545-0074

2014

Form

(For Holders of Qualified Mortgage Credit Certificates Issued by

State or Local Governmental Units or Agencies)

Information about Form 8396 and its instructions is at

▶

Department of the Treasury

Attachment

138

Internal Revenue Service (99)

Sequence No.

Attach to Form 1040 or 1040NR.

▶

Name(s) shown on your tax return

Your social security number

Enter the address of your main home to which the qualified mortgage certificate relates if it is different from the address shown on your tax return.

Name of Issuer of Mortgage Credit Certificate

Mortgage Credit Certificate Number

Issue Date

Before you begin Part I, figure the amounts of any of the following credits you are claiming: Credit for the elderly or the disabled,

alternative motor vehicle credit, and qualified plug-in electric drive motor vehicle credit.

Part I

Current Year Mortgage Interest Credit

1

Interest paid on the certified indebtedness amount. If someone else (other than your spouse if

1

filing jointly) also held an interest in the home, enter only your share of the interest paid .

.

.

2

Enter the certificate credit rate shown on your mortgage credit certificate. Do not enter the

2

interest rate on your home mortgage .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

%

3

If line 2 is 20% or less, multiply line 1 by line 2. If line 2 is more than 20%, or you refinanced

3

your mortgage and received a reissued certificate, see the instructions for the amount to enter .

You must reduce your deduction for home mortgage interest on Schedule A (Form 1040)

by the amount on line 3.

4

4

Enter any 2011 credit carryforward from line 16 of your 2013 Form 8396 .

.

.

.

.

.

.

.

5

Enter any 2012 credit carryforward from line 14 of your 2013 Form 8396 .

.

.

.

.

.

.

.

5

6

Enter any 2013 credit carryforward from line 17 of your 2013 Form 8396 .

.

.

.

.

.

.

.

6

7

7

Add lines 3 through 6 .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

8

Limitation based on tax liability. Enter the amount from the Credit Limit Worksheet (see

8

instructions) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

9

Current year mortgage interest credit. Enter the smaller of line 7 or line 8. Also include this

amount in the total on Form 1040, line 54, or Form 1040NR, line 51. Check box c on that line and

9

enter “8396” in the space next to that box .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

Part II

Mortgage Interest Credit Carryforward to 2015. (Complete only if line 9 is less than line 7.)

10

10

Add lines 3 and 4 .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

11

Enter the amount from line 7 .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

11

12

Enter the larger of line 9 or line 10 .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

12

13

13

Subtract line 12 from line 11 .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

14

2013 credit carryforward to 2015. Enter the smaller of line 6 or line 13 .

.

.

.

.

.

.

.

14

15

15

Subtract line 14 from line 13 .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

16

2012 credit carryforward to 2015. Enter the smaller of line 5 or line 15 .

.

.

.

.

.

.

.

16

17

2014 credit carryforward to 2015. Subtract line 9 from line 3. If zero or less, enter -0- .

.

.

17

8396

For Paperwork Reduction Act Notice, see your tax return instructions.

Form

(2014)

Cat. No. 62502X

1

1 2

2