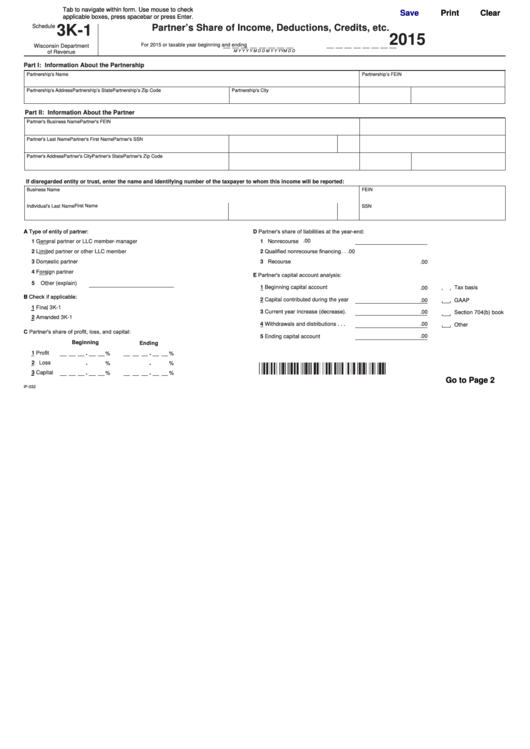

Tab to navigate within form. Use mouse to check

Save

Print

Clear

applicable boxes, press spacebar or press Enter.

Schedule

3K-1

Partner’s Share of Income, Deductions, Credits, etc.

2015

For 2015 or taxable year beginning

and ending

Wisconsin Department

M

M

D

D

Y

Y

Y

Y

M

M

D

D

Y

Y

Y

Y

of Revenue

Part I: Information About the Partnership

Partnership's Name

Partnership’s FEIN

Partnership's Address

Partnership's City

Partnership’s State

Partnership’s Zip Code

Part II: Information About the Partner

Partner's Business Name

Partner's FEIN

Partner's Last Name

Partner's First Name

M.l.

Partner's SSN

Partner's Address

Partner's City

Partner's State

Partner's Zip Code

If disregarded entity or trust, enter the name and identifying number of the taxpayer to whom this income will be reported:

Business Name

FEIN

First Name

Individual's Last Name

M.I.

SSN

A Type of entity of partner:

D Partner's share of liabilities at the year-end:

.00

1

General partner or LLC member-manager

1 Nonrecourse . . . . . . . . . . . . . . . . .

2 Qualified nonrecourse financing . .

2

Limited partner or other LLC member

.00

3

Domestic partner

3 Recourse . . . . . . . . . . . . . . . . . . .

.00

4

Foreign partner

E Partner's capital account analysis:

5

Other (explain)

1 Beginning capital account . . . . . .

Tax basis

.00

B Check if applicable:

2 Capital contributed during the year

.00

GAAP

1

Final 3K-1

3 Current year increase (decrease).

.00

Section 704(b) book

2

Amended 3K-1

4 Withdrawals and distributions . . .

.00

Other

C Partner's share of profit, loss, and capital:

.00

5 Ending capital account . . . . . . . . .

Beginning

Ending

1 Profit

.

.

%

%

2 Loss

.

.

%

%

3 Capital

.

.

%

%

Go to Page 2

IP-032

1

1 2

2 3

3 4

4 5

5 6

6