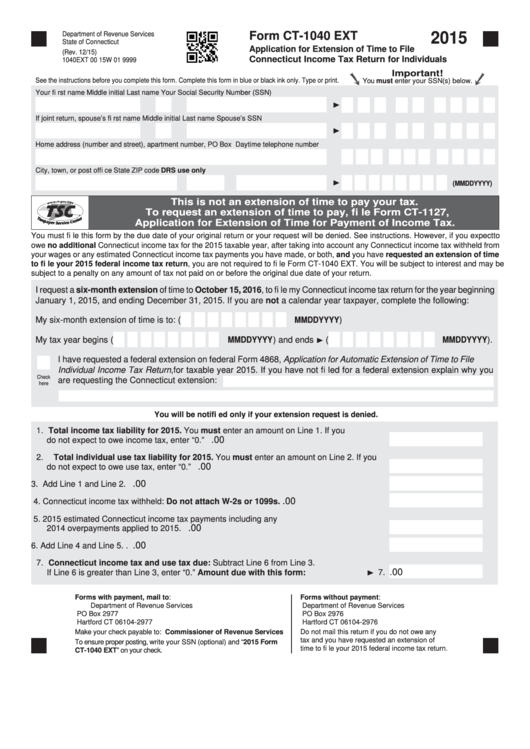

Form Ct-1040 Ext - Application For Extension Of Time To File Connecticut Income Tax Return For Individuals - 2015

ADVERTISEMENT

Department of Revenue Services

Form CT-1040 EXT

2015

State of Connecticut

Application for Extension of Time to File

(Rev. 12/15)

Connecticut Income Tax Return for Individuals

1040EXT 00 15W 01 9999

Important!

See the instructions before you complete this form. Complete this form in blue or black ink only. Type or print.

You must enter your SSN(s) below.

Your fi rst name

Middle initial Last name

Your Social Security Number (SSN)

If joint return, spouse’s fi rst name Middle initial Last name

Spouse’s SSN

Home address (number and street), apartment number, PO Box

Daytime telephone number

City, town, or post offi ce

State

ZIP code

DRS use only

(MMDDYYYY)

This is not an extension of time to pay your tax.

To request an extension of time to pay, fi le Form CT-1127,

Application for Extension of Time for Payment of Income Tax.

You must fi le this form by the due date of your original return or your request will be denied. See instructions. However, if you expect to

owe no additional Connecticut income tax for the 2015 taxable year, after taking into account any Connecticut income tax withheld from

your wages or any estimated Connecticut income tax payments you have made, or both, and you have requested an extension of time

to fi le your 2015 federal income tax return, you are not required to fi le Form CT-1040 EXT. You will be subject to interest and may be

subject to a penalty on any amount of tax not paid on or before the original due date of your return.

I request a six-month extension of time to October 15, 2016, to fi le my Connecticut income tax return for the year beginning

January 1, 2015, and ending December 31, 2015. If you are not a calendar year taxpayer, complete the following:

My six-month extension of time is to:

(MMDDYYYY)

My tax year begins

(MMDDYYYY) and ends

(MMDDYYYY).

I have requested a federal extension on federal Form 4868, Application for Automatic Extension of Time to File U.S.

Individual Income Tax Return, for taxable year 2015. If you have not fi led for a federal extension explain why you

Check

are requesting the Connecticut extension:

here

You will be notifi ed only if your extension request is denied.

1. Total income tax liability for 2015. You must enter an amount on Line 1. If you

.00

do not expect to owe income tax, enter “0.” ......................................................................... 1.

2. Total individual use tax liability for 2015. You must enter an amount on Line 2. If you

.00

do not expect to owe use tax, enter “0.” ............................................................................... 2.

.00

3. Add Line 1 and Line 2. .......................................................................................................... 3.

.00

4. Connecticut income tax withheld: Do not attach W-2s or 1099s. ....................................... 4.

5. 2015 estimated Connecticut income tax payments including any

.00

2014 overpayments applied to 2015. ................................................................................... 5.

.00

6. Add Line 4 and Line 5. . ......................................................................................................... 6.

7. Connecticut income tax and use tax due: Subtract Line 6 from Line 3.

.00

If Line 6 is greater than Line 3, enter “0.” Amount due with this form: ..........................

7.

Forms with payment, mail to:

Forms without payment:

Department of Revenue Services

Department of Revenue Services

PO Box 2977

PO Box 2976

Hartford CT 06104-2977

Hartford CT 06104-2976

Make your check payable to: Commissioner of Revenue Services

Do not mail this return if you do not owe any

tax and you have requested an extension of

To ensure proper posting, write your SSN (optional) and “2015 Form

time to fi le your 2015 federal income tax return.

CT-1040 EXT” on your check.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2