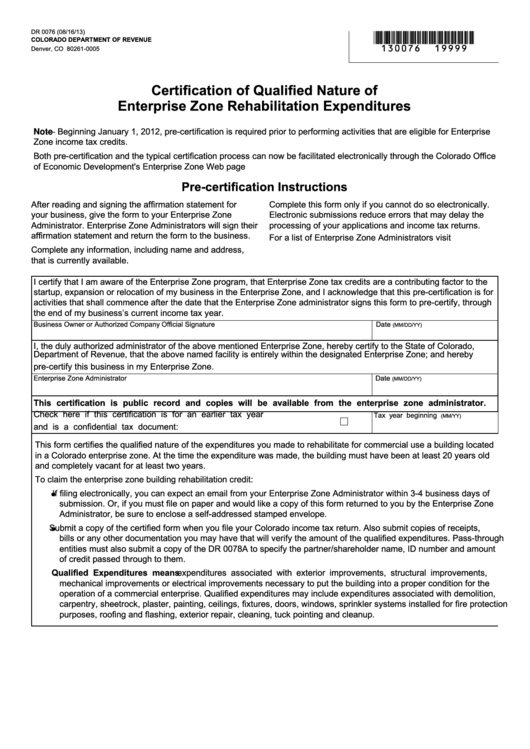

DR 0076 (08/16/13)

*130076==19999*

colorado dEParTmEnT of rEvEnuE

Denver, CO 80261-0005

certification of Qualified nature of

Enterprise Zone rehabilitation Expenditures

Note — Beginning January 1, 2012, pre-certification is required prior to performing activities that are eligible for Enterprise

Zone income tax credits.

Both pre-certification and the typical certification process can now be facilitated electronically through the Colorado Office

of Economic Development's Enterprise Zone Web page

Pre-certification Instructions

After reading and signing the affirmation statement for

Complete this form only if you cannot do so electronically.

your business, give the form to your Enterprise Zone

Electronic submissions reduce errors that may delay the

Administrator. Enterprise Zone Administrators will sign their

processing of your applications and income tax returns.

affirmation statement and return the form to the business.

For a list of Enterprise Zone Administrators visit

Complete any information, including name and address,

that is currently available.

I certify that I am aware of the Enterprise Zone program, that Enterprise Zone tax credits are a contributing factor to the

startup, expansion or relocation of my business in the Enterprise Zone, and I acknowledge that this pre-certification is for

activities that shall commence after the date that the Enterprise Zone administrator signs this form to pre-certify, through

the end of my business’s current income tax year.

Business Owner or Authorized Company Official Signature

Date

(MM/DD/YY)

I, the duly authorized administrator of the above mentioned Enterprise Zone, hereby certify to the State of Colorado,

Department of Revenue, that the above named facility is entirely within the designated Enterprise Zone; and hereby

pre-certify this business in my Enterprise Zone.

Enterprise Zone Administrator

Date

(MM/DD/YY)

This certification is public record and copies will be available from the enterprise zone administrator.

Check here if this certification is for an earlier tax year

Tax year beginning

(MM/YY)

and is a confidential tax document:

This form certifies the qualified nature of the expenditures you made to rehabilitate for commercial use a building located

in a Colorado enterprise zone. At the time the expenditure was made, the building must have been at least 20 years old

and completely vacant for at least two years.

To claim the enterprise zone building rehabilitation credit:

If filing electronically, you can expect an email from your Enterprise Zone Administrator within 3-4 business days of

submission. Or, if you must file on paper and would like a copy of this form returned to you by the Enterprise Zone

Administrator, be sure to enclose a self-addressed stamped envelope.

Submit a copy of the certified form when you file your Colorado income tax return. Also submit copies of receipts,

bills or any other documentation you may have that will verify the amount of the qualified expenditures. Pass-through

entities must also submit a copy of the DR 0078A to specify the partner/shareholder name, ID number and amount

of credit passed through to them.

Qualified Expenditures means expenditures associated with exterior improvements, structural improvements,

mechanical improvements or electrical improvements necessary to put the building into a proper condition for the

operation of a commercial enterprise. Qualified expenditures may include expenditures associated with demolition,

carpentry, sheetrock, plaster, painting, ceilings, fixtures, doors, windows, sprinkler systems installed for fire protection

purposes, roofing and flashing, exterior repair, cleaning, tuck pointing and cleanup.

1

1 2

2