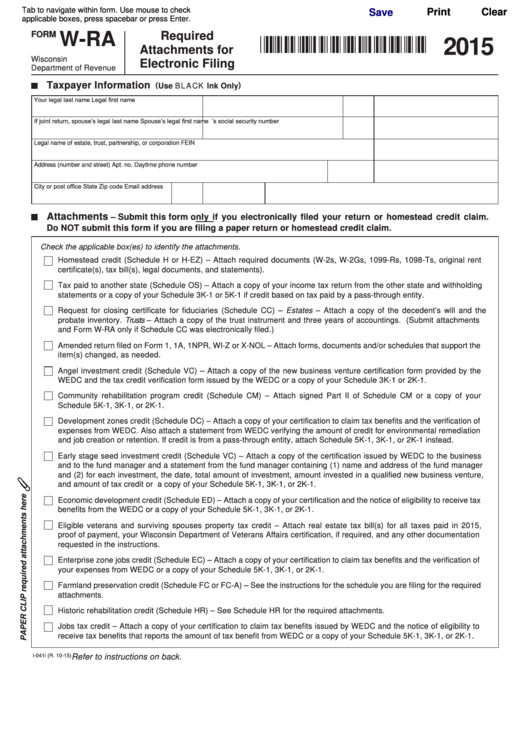

Tab to navigate within form. Use mouse to check

Print

Clear

Save

applicable boxes, press spacebar or press Enter.

FORM

W-RA

Required

2015

Attachments for

Wisconsin

Electronic Filing

Department of Revenue

( Use BLACK Ink Only )

Taxpayer Information

Your legal last name

Legal first name

M.I.

Your social security number

If joint return, spouse’s legal last name

Spouse’s legal first name

M.I.

Spouse’s social security number

Legal name of estate, trust, partnership, or corporation

FEIN

Address (number and street)

Apt. no.

Daytime phone number

City or post office

State

Zip code

Email address

Attachments

– Submit this form only if you electronically filed your return or homestead credit claim.

Do NOT submit this form if you are filing a paper return or homestead credit claim.

Check the applicable box(es) to identify the attachments.

Homestead credit (Schedule H or H-EZ) – Attach required documents (W-2s, W-2Gs, 1099-Rs, 1098-Ts, original rent

certificate(s), tax bill(s), legal documents, and statements).

Tax paid to another state (Schedule OS) – Attach a copy of your income tax return from the other state and withholding

statements or a copy of your Schedule 3K-1 or 5K-1 if credit based on tax paid by a pass-through entity.

Request for closing certificate for fiduciaries (Schedule CC) – Estates – Attach a copy of the decedent’s will and the

probate inventory. Trusts – Attach a copy of the trust instrument and three years of accountings. (Submit attachments

and Form W-RA only if Schedule CC was electronically filed.)

Amended return filed on Form 1, 1A, 1NPR, WI-Z or X-NOL – Attach forms, documents and/or schedules that support the

item(s) changed, as needed.

Angel investment credit (Schedule VC) – Attach a copy of the new business venture certification form provided by the

WEDC and the tax credit verification form issued by the WEDC or a copy of your Schedule 3K-1 or 2K-1.

Community rehabilitation program credit (Schedule CM) – Attach signed Part II of Schedule CM or a copy of your

Schedule 5K-1, 3K-1, or 2K-1.

Development zones credit (Schedule DC) – Attach a copy of your certification to claim tax benefits and the verification of

expenses from WEDC. Also attach a statement from WEDC verifying the amount of credit for environmental remediation

and job creation or retention. If credit is from a pass-through entity, attach Schedule 5K-1, 3K-1, or 2K-1 instead.

Early stage seed investment credit (Schedule VC) – Attach a copy of the certification issued by WEDC to the business

and to the fund manager and a statement from the fund manager containing (1) name and address of the fund manager

and (2) for each investment, the date, total amount of investment, amount invested in a qualified new business venture,

and amount of tax credit or a copy of your Schedule 5K-1, 3K-1, or 2K-1.

Economic development credit (Schedule ED) – Attach a copy of your certification and the notice of eligibility to receive tax

benefits from the WEDC or a copy of your Schedule 5K-1, 3K-1, or 2K-1.

Eligible veterans and surviving spouses property tax credit – Attach real estate tax bill(s) for all taxes paid in 2015,

proof of payment, your Wisconsin Department of Veterans Affairs certification, if required, and any other documentation

requested in the instructions.

Enterprise zone jobs credit (Schedule EC) – Attach a copy of your certification to claim tax benefits and the verification of

your expenses from WEDC or a copy of your Schedule 5K-1, 3K-1, or 2K-1.

Farmland preservation credit (Schedule FC or FC-A) – See the instructions for the schedule you are filing for the required

attachments.

Historic rehabilitation credit (Schedule HR) – See Schedule HR for the required attachments.

Jobs tax credit – Attach a copy of your certification to claim tax benefits issued by WEDC and the notice of eligibility to

receive tax benefits that reports the amount of tax benefit from WEDC or a copy of your Schedule 5K-1, 3K-1, or 2K-1.

I-041i (R. 10-15)

Refer to instructions on back.

1

1 2

2