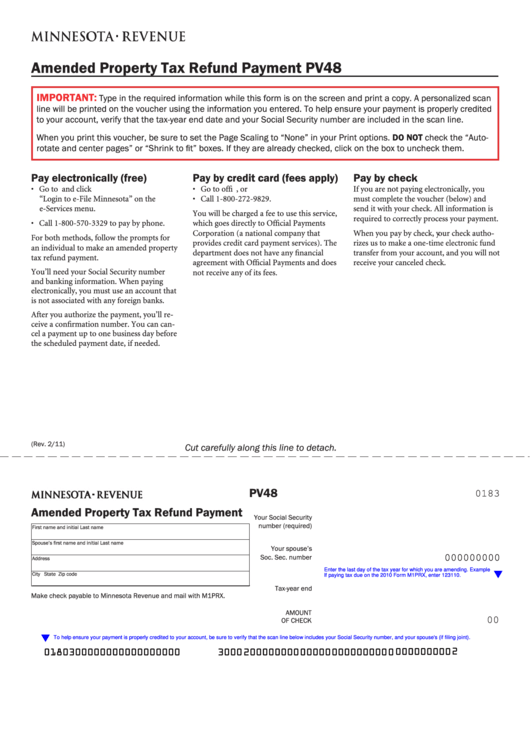

Amended Property Tax Refund Payment

PV48

IMPORTANT:

Type in the required information while this form is on the screen and print a copy. A personalized scan

line will be printed on the voucher using the information you entered. To help ensure your payment is properly credited

to your account, verify that the tax-year end date and your Social Security number are included in the scan line.

When you print this voucher, be sure to set the Page Scaling to “None” in your Print options. DO NOT check the “Auto-

rotate and center pages” or “Shrink to fit” boxes. If they are already checked, click on the box to uncheck them.

Pay electronically (free)

Pay by credit card (fees apply)

Pay by check

• Go to and click

• Go to , or

If you are not paying electronically, you

“Login to e-File Minnesota” on the

• Call 1-800-272-9829.

must complete the voucher (below) and

e-Services menu.

send it with your check. All information is

You will be charged a fee to use this service,

required to correctly process your payment.

• Call 1-800-570-3329 to pay by phone.

which goes directly to Official Payments

Corporation (a national company that

When you pay by check, your check autho-

For both methods, follow the prompts for

provides credit card payment services). The

rizes us to make a one-time electronic fund

an individual to make an amended property

department does not have any financial

transfer from your account, and you will not

tax refund payment.

agreement with Official Payments and does

receive your canceled check.

You’ll need your Social Security number

not receive any of its fees.

and banking information. When paying

electronically, you must use an account that

is not associated with any foreign banks.

After you authorize the payment, you’ll re-

ceive a confirmation number. You can can-

cel a payment up to one business day before

the scheduled payment date, if needed.

(Rev. 2/11)

Cut carefully along this line to detach.

PV48

0183

Amended Property Tax Refund Payment

Your Social Security

number (required)

First name and initial

Last name

Spouse’s first name and initial

Last name

Your spouse’s

Soc. Sec. number

000000000

Address

Enter the last day of the tax year for which you are amending. Example:

City

State

Zip code

If paying tax due on the 2010 Form M1PRX, enter 123110.

Tax-year end

Make check payable to Minnesota Revenue and mail with M1PRX.

AMOUNT

OF CHECK

00

To help ensure your payment is properly credited to your account, be sure to verify that the scan line below includes your Social Security number, and your spouse's (if filing joint).

0180300000000000000000

3000 200000000 00000 000000000 0 0000000000 2

1

1