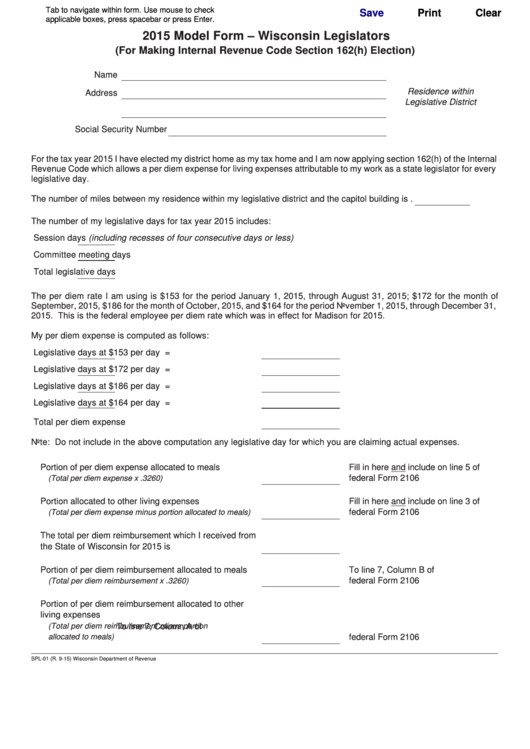

Tab to navigate within form. Use mouse to check

Save

Print

Clear

applicable boxes, press spacebar or press Enter.

2015 Model Form – Wisconsin Legislators

(For Making Internal Revenue Code Section 162(h) Election)

Name

Residence within

Address

Legislative District

Social Security Number

For the tax year 2015 I have elected my district home as my tax home and I am now applying section 162(h) of the Internal

Revenue Code which allows a per diem expense for living expenses attributable to my work as a state legislator for every

legislative day.

The number of miles between my residence within my legislative district and the capitol building is

.

The number of my legislative days for tax year 2015 includes:

Session days (including recesses of four consecutive days or less)

Committee meeting days

Total legislative days

The per diem rate I am using is $153 for the period January 1, 2015, through August 31, 2015; $172 for the month of

September, 2015, $186 for the month of October, 2015, and $164 for the period November 1, 2015, through December 31,

2015. This is the federal employee per diem rate which was in effect for Madison for 2015.

My per diem expense is computed as follows:

Legislative days at $153 per day =

Legislative days at $172 per day =

Legislative days at $186 per day =

Legislative days at $164 per day =

Total per diem expense

Note: Do not include in the above computation any legislative day for which you are claiming actual expenses.

Portion of per diem expense allocated to meals

Fill in here and include on line 5 of

federal Form 2106

(Total per diem expense x .3260) . . . . . . . . . . . . . . . . . . . . . .

Portion allocated to other living expenses

Fill in here and include on line 3 of

federal Form 2106

(Total per diem expense minus portion allocated to meals)

The total per diem reimbursement which I received from

the State of Wisconsin for 2015 is . . . . . . . . . . . . . . . . .

Portion of per diem reimbursement allocated to meals

To line 7, Column B of

. . . . . . . . . . . . . .

federal Form 2106

(Total per diem reimbursement x .3260)

Portion of per diem reimbursement allocated to other

living expenses

(Total per diem reimbursement minus portion

To line 7, Column A of

. . . . . . . . . . . . . . . . . . . . . . . . . . . . .

allocated to meals)

federal Form 2106

SPL-01 (R. 9-15)

Wisconsin Department of Revenue

1

1