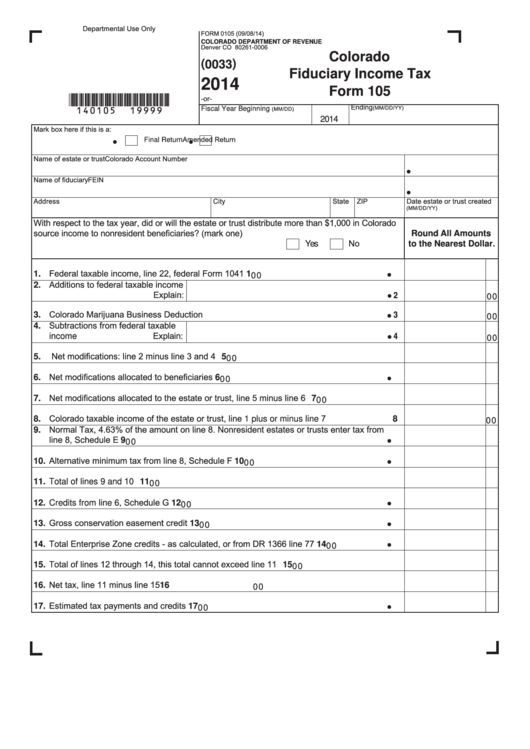

Departmental Use Only

FORM 0105 (09/08/14)

COLORADO DEPARTMENT OF REVENUE

Denver CO 80261-0006

Colorado

( 0033 )

Fiduciary Income Tax

2014

Form 105

*140105==19999*

-or-

Ending

(MM/DD)

(MM/DD/YY)

Fiscal Year Beginning

2014

Mark box here if this is a:

Amended Return

Final Return

Name of estate or trust

Colorado Account Number

Name of fiduciary

FEIN

Address

State

ZIP

Date estate or trust created

City

(MM/DD/YY)

With respect to the tax year, did or will the estate or trust distribute more than $1,000 in Colorado

source income to nonresident beneficiaries? (mark one)

Round All Amounts

No

Yes

to the Nearest Dollar.

1. Federal taxable income, line 22, federal Form 1041

1

00

2. Additions to federal taxable income

Explain:

2

00

3. Colorado Marijuana Business Deduction

3

00

4. Subtractions from federal taxable

Explain:

income

4

00

Net modifications: line 2 minus line 3 and 4

5.

5

00

6. Net modifications allocated to beneficiaries

6

00

7. Net modifications allocated to the estate or trust, line 5 minus line 6

7

00

8. Colorado taxable income of the estate or trust, line 1 plus or minus line 7

8

00

9. Normal Tax, 4.63% of the amount on line 8. Nonresident estates or trusts enter tax from

line 8, Schedule E

9

00

10. Alternative minimum tax from line 8, Schedule F

10

00

11. Total of lines 9 and 10

11

00

12. Credits from line 6, Schedule G

12

00

13. Gross conservation easement credit

13

00

14. Total Enterprise Zone credits - as calculated, or from DR 1366 line 77

14

00

15. Total of lines 12 through 14, this total cannot exceed line 11

15

00

16. Net tax, line 11 minus line 15

16

00

17. Estimated tax payments and credits

17

00

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8