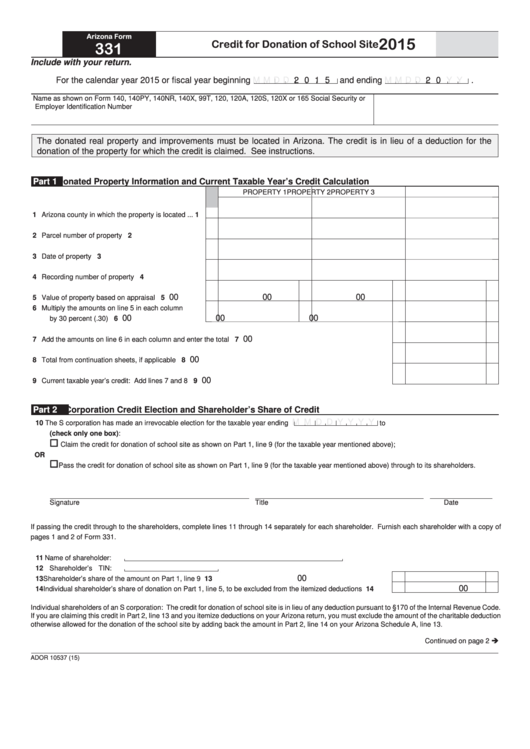

Arizona Form

2015

Credit for Donation of School Site

331

Include with your return.

For the calendar year 2015 or fiscal year beginning

2 0 1 5 and ending

.

M M D D

M M D D

2 0

Y Y

Name as shown on Form 140, 140PY, 140NR, 140X, 99T, 120, 120A, 120S, 120X or 165

Social Security or

Employer Identification Number

The donated real property and improvements must be located in Arizona. The credit is in lieu of a deduction for the

donation of the property for which the credit is claimed. See instructions.

Donated Property Information and Current Taxable Year’s Credit Calculation

Part 1

PROPERTY 1

PROPERTY 2

PROPERTY 3

1

Arizona county in which the property is located ...

1

2

Parcel number of property ....................................

2

3

Date of property conveyance................................

3

4

Recording number of property conveyance..........

4

00

00

00

5

Value of property based on appraisal ...................

5

6

Multiply the amounts on line 5 in each column

00

00

00

by 30 percent (.30) ...............................................

6

00

7

Add the amounts on line 6 in each column and enter the total .............................................................................

7

00

8

Total from continuation sheets, if applicable ..........................................................................................................

8

00

9

Current taxable year’s credit: Add lines 7 and 8 ...................................................................................................

9

Part 2

S Corporation Credit Election and Shareholder’s Share of Credit

M M D D Y Y Y Y

10 The S corporation has made an irrevocable election for the taxable year ending

to

(check only one box):

Claim the credit for donation of school site as shown on Part 1, line 9 (for the taxable year mentioned above);

OR

Pass the credit for donation of school site as shown on Part 1, line 9 (for the taxable year mentioned above) through to its shareholders.

Signature

Title

Date

If passing the credit through to the shareholders, complete lines 11 through 14 separately for each shareholder. Furnish each shareholder with a copy of

pages 1 and 2 of Form 331.

11 Name of shareholder:

12 Shareholder’s TIN:

00

13 Shareholder’s share of the amount on Part 1, line 9 ............................................................................................... 13

00

14 Individual shareholder’s share of donation on Part 1, line 5, to be excluded from the itemized deductions ........... 14

Individual shareholders of an S corporation: The credit for donation of school site is in lieu of any deduction pursuant to §170 of the Internal Revenue Code.

If you are claiming this credit in Part 2, line 13 and you itemize deductions on your Arizona return, you must exclude the amount of the charitable deduction

otherwise allowed for the donation of the school site by adding back the amount in Part 2, line 14 on your Arizona Schedule A, line 13.

Continued on page 2

ADOR 10537 (15)

1

1 2

2