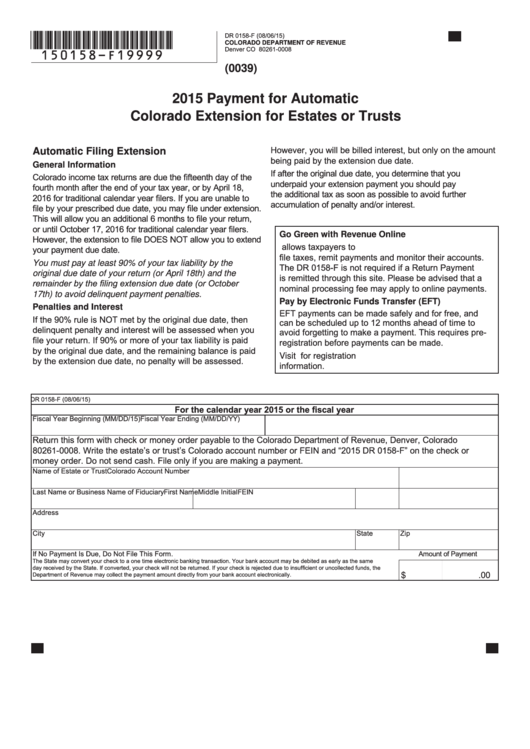

*150158-F19999*

DR 0158-F (08/06/15)

COLORADO DEPARTMENT OF REVENUE

Denver CO 80261-0008

(0039)

2015 Payment for Automatic

Colorado Extension for Estates or Trusts

However, you will be billed interest, but only on the amount

Automatic Filing Extension

being paid by the extension due date.

General Information

If after the original due date, you determine that you

Colorado income tax returns are due the fifteenth day of the

underpaid your extension payment you should pay

fourth month after the end of your tax year, or by April 18,

the additional tax as soon as possible to avoid further

2016 for traditional calendar year filers. If you are unable to

accumulation of penalty and/or interest.

file by your prescribed due date, you may file under extension.

This will allow you an additional 6 months to file your return,

or until October 17, 2016 for traditional calendar year filers.

Go Green with Revenue Online

However, the extension to file DOES NOT allow you to extend

allows taxpayers to

your payment due date.

file taxes, remit payments and monitor their accounts.

You must pay at least 90% of your tax liability by the

The DR 0158-F is not required if a Return Payment

original due date of your return (or April 18th) and the

is remitted through this site. Please be advised that a

remainder by the filing extension due date (or October

nominal processing fee may apply to online payments.

17th) to avoid delinquent payment penalties.

Pay by Electronic Funds Transfer (EFT)

Penalties and Interest

EFT payments can be made safely and for free, and

If the 90% rule is NOT met by the original due date, then

can be scheduled up to 12 months ahead of time to

delinquent penalty and interest will be assessed when you

avoid forgetting to make a payment. This requires pre-

file your return. If 90% or more of your tax liability is paid

registration before payments can be made.

by the original due date, and the remaining balance is paid

Visit for registration

by the extension due date, no penalty will be assessed.

information.

DR 0158-F (08/06/15)

For the calendar year 2015 or the fiscal year

Fiscal Year Beginning (MM/DD/15)

Fiscal Year Ending (MM/DD/YY)

Return this form with check or money order payable to the Colorado Department of Revenue, Denver, Colorado

80261-0008. Write the estate’s or trust’s Colorado account number or FEIN and “2015 DR 0158-F” on the check or

money order. Do not send cash. File only if you are making a payment.

Name of Estate or Trust

Colorado Account Number

Last Name or Business Name of Fiduciary

First Name

Middle Initial FEIN

Address

City

State

Zip

If No Payment Is Due, Do Not File This Form.

Amount of Payment

The State may convert your check to a one time electronic banking transaction. Your bank account may be debited as early as the same

day received by the State. If converted, your check will not be returned. If your check is rejected due to insufficient or uncollected funds, the

.0 0

Department of Revenue may collect the payment amount directly from your bank account electronically.

$

1

1