DR 0105EP (06/23/14)

COLORADO DEPARTMENT OF REVENUE

Denver, CO 80261-0008

COLORADO

2015

Estimated Tax - Estates & Trusts

Instructions

Estimated tax is not required for estates or trusts.

Go Green with Revenue Online

However, these forms are provided for those who prefer

allows taxpayers to

filing estimated tax. These forms should not be used to

file taxes, make payments and monitor their accounts.

remit payment on behalf of individual beneficiaries of the

Form 105EP is not required if an electronic payment is

estate or trust.

paid through this site. Please be advised that a nominal

Calculating the Payment

processing fee may apply to online payments.

Estimated tax payments can be made on a quarterly

basis. When making payments, be sure to use the same

Pay by Electronic Funds Transfer (EFT)

account numbers that are used when filing the annual 105

EFT payments can be made safely and for free, and

return.

can be scheduled up to 12 months ahead of time to

avoid forgetting to make a payment. This requires

It is strongly recommended that these payments be

pre-registration before payments can be made.

submitted electronically to avoid problems and delays.

Visit for registration

The single form can be copied and used for each of the

information.

four quarterly payments if an electronic payment cannot

be made for any reason.

Additional information, FYI publications and forms are

Penalties

available at , or you can call

There is no penalty for failure to file estimated tax for

303-238-SERV (7378) for assistance.

estates or trusts.

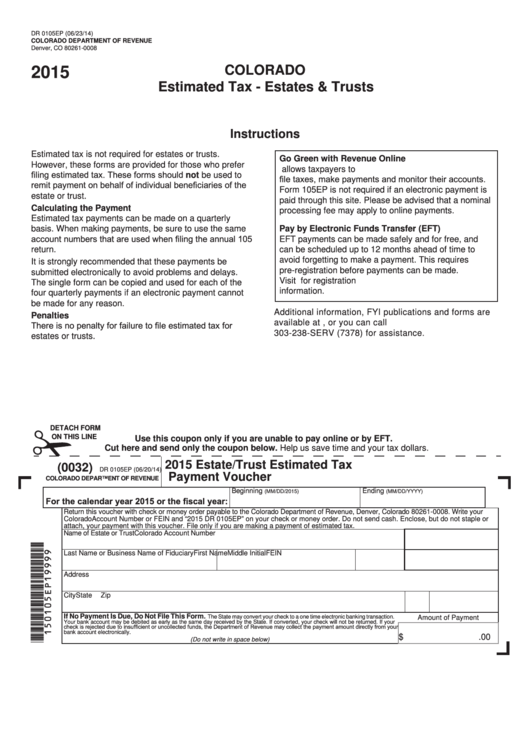

DETACH FORM

ON THIS LINE

Use this coupon only if you are unable to pay online or by EFT.

Cut here and send only the coupon below. Help us save time and your tax dollars.

2015 Estate/Trust Estimated Tax

(0032)

DR 0105EP (06/20/14)

Payment Voucher

COLORADO DEPARTMENT OF REVENUE

Beginning

Ending

(MM/DD/2015)

(MM/DD/YYYY)

For the calendar year 2015 or the fiscal year:

Return this voucher with check or money order payable to the Colorado Department of Revenue, Denver, Colorado 80261-0008. Write your

Colorado Account Number or FEIN and “2015 DR 0105EP” on your check or money order. Do not send cash. Enclose, but do not staple or

attach, your payment with this voucher. File only if you are making a payment of estimated tax.

Name of Estate or Trust

Colorado Account Number

Last Name or Business Name of Fiduciary

First Name

Middle Initial

FEIN

Address

City

State

Zip

If No Payment Is Due, Do Not File This Form.

The State may convert your check to a one time electronic banking transaction.

Amount of Payment

Your bank account may be debited as early as the same day received by the State. If converted, your check will not be returned. If your

check is rejected due to insufficient or uncollected funds, the Department of Revenue may collect the payment amount directly from your

bank account electronically.

$

.00

(Do not write in space below)

1

1