Tab to navigate within form. Use mouse to check

Save

Print

Clear

Instructions

applicable boxes, press spacebar, or press Enter.

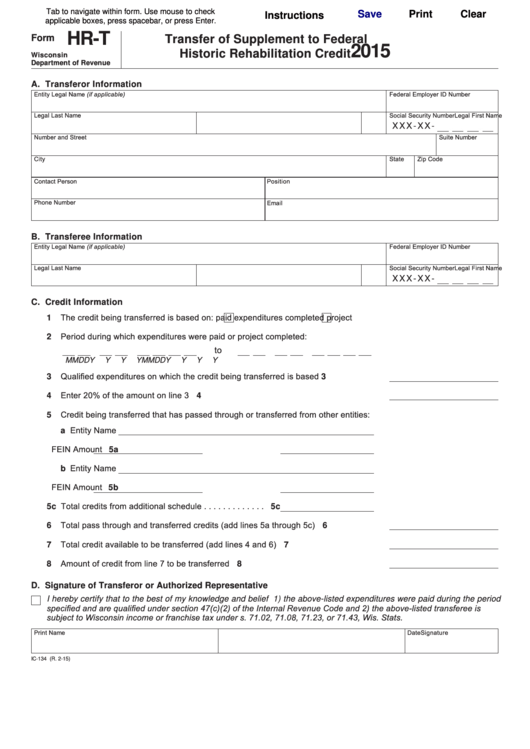

HR-T

Form

Transfer of Supplement to Federal

2015

Historic Rehabilitation Credit

Wisconsin

Department of Revenue

A. Transferor Information

Entity Legal Name (if applicable)

Federal Employer ID Number

Legal Last Name

Legal First Name

M .I .

Social Security Number

X X X-X X-

Number and Street

Suite Number

City

State

Zip Code

Contact Person

Position

Phone Number

Email

B. Transferee Information

Entity Legal Name (if applicable)

Federal Employer ID Number

Legal Last Name

Legal First Name

M .I .

Social Security Number

X X X-X X-

C. Credit Information

1 The credit being transferred is based on:

paid expenditures

completed project

2 Period during which expenditures were paid or project completed:

to

M

M

D

D

Y

Y

Y

Y

M

M

D

D

Y

Y

Y

Y

3 Qualified expenditures on which the credit being transferred is based . . . . . . . . . . . 3

4 Enter 20% of the amount on line 3 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

5 Credit being transferred that has passed through or transferred from other entities:

a Entity Name

FEIN

Amount 5a

b Entity Name

FEIN

Amount 5b

5c Total credits from additional schedule . . . . . . . . . . . . . 5c

6 Total pass through and transferred credits (add lines 5a through 5c) . . . . . . . . . . . . 6

7 Total credit available to be transferred (add lines 4 and 6) . . . . . . . . . . . . . . . . . . . . 7

8 Amount of credit from line 7 to be transferred . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

D. Signature of Transferor or Authorized Representative

I hereby certify that to the best of my knowledge and belief 1) the above-listed expenditures were paid during the period

specified and are qualified under section 47(c)(2) of the Internal Revenue Code and 2) the above-listed transferee is

subject to Wisconsin income or franchise tax under s. 71.02, 71.08, 71.23, or 71.43, Wis. Stats.

Print Name

Signature

Date

IC-134 (R. 2-15)

1

1 2

2