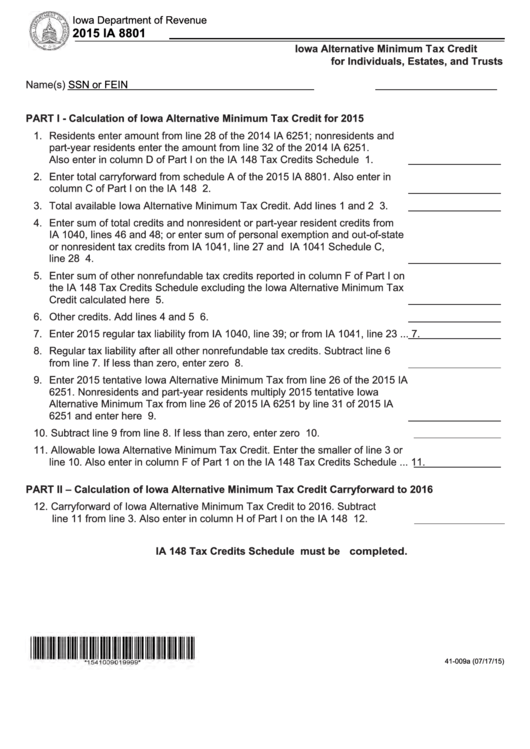

Iowa Department of Revenue

2015 IA 8801

https://tax.iowa.gov

I ow a Al te rna ti ve Mi ni mum Tax Credit

for Individuals, Estates, and Trusts

Name(s)

SSN or FEIN

PART I - Calculation of Iowa Alternative Minimum Tax Credit for 2015

1. Residents enter amount from line 28 of the 2014 IA 6251; nonresidents and

part-year residents enter the amount from line 32 of the 2014 IA 6251.

Also enter in column D of Part I on the IA 148 Tax Credits Schedule ................ 1.

2. Enter total carryforward from schedule A of the 2015 IA 8801. Also enter in

column C of Part I on the IA 148 ......................................................................... 2.

3. Total available Iowa Alternative Minimum Tax Credit. Add lines 1 and 2 ........... 3.

4. Enter sum of total credits and nonresident or part-year resident credits from

IA 1040, lines 46 and 48; or enter sum of personal exemption and out-of-state

or nonresident tax credits from IA 1041, line 27 and IA 1041 Schedule C,

line 28 ................................................................................................................. 4.

5. Enter sum of other nonrefundable tax credits reported in column F of Part I on

the IA 148 Tax Credits Schedule excluding the Iowa Alternative Minimum Tax

Credit calculated here ......................................................................................... 5.

6. Other credits. Add lines 4 and 5 .......................................................................... 6.

7. Enter 2015 regular tax liability from IA 1040, line 39; or from IA 1041, line 23 ... 7.

8. Regular tax liability after all other nonrefundable tax credits. Subtract line 6

from line 7. If less than zero, enter zero .............................................................. 8.

9. Enter 2015 tentative Iowa Alternative Minimum Tax from line 26 of the 2015 IA

6251. Nonresidents and part-year residents multiply 2015 tentative Iowa

Alternative Minimum Tax from line 26 of 2015 IA 6251 by line 31 of 2015 IA

6251 and enter here ........................................................................................... 9.

10. Subtract line 9 from line 8. If less than zero, enter zero ...................................... 10.

11. Allowable Iowa Alternative Minimum Tax Credit. Enter the smaller of line 3 or

line 10. Also enter in column F of Part 1 on the IA 148 Tax Credits Schedule ... 11.

PART II – Calculation of Iowa Alternative Minimum Tax Credit Carryforward to 2016

12. Carryforward of Iowa Alternative Minimum Tax Credit to 2016. Subtract

line 11 from line 3. Also enter in column H of Part I on the IA 148 ................. 12.

IA 148 Tax Credits Schedule must be completed.

41-009a (07/17/15)

1

1 2

2