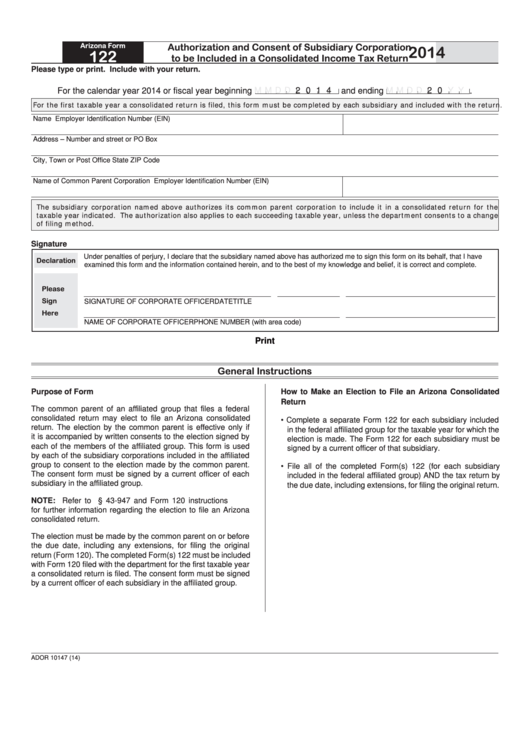

Authorization and Consent of Subsidiary Corporation

Arizona Form

2014

122

to be Included in a Consolidated Income Tax Return

Please type or print. Include with your return.

M M D D

2 0 1 4 and ending

M M D D

2 0

Y Y

For the calendar year 2014 or fiscal year beginning

.

For the first taxable year a consolidated return is filed, this form must be completed by each subsidiary and included with the return.

Name

Employer Identification Number (EIN)

Address – Number and street or PO Box

City, Town or Post Office

State

ZIP Code

Name of Common Parent Corporation

Employer Identification Number (EIN)

The subsidiary corporation named above authorizes its common parent corporation to include it in a consolidated return for the

taxable year indicated. The authorization also applies to each succeeding taxable year, unless the department consents to a change

of filing method.

Signature

Under penalties of perjury, I declare that the subsidiary named above has authorized me to sign this form on its behalf, that I have

Declaration

examined this form and the information contained herein, and to the best of my knowledge and belief, it is correct and complete.

Please

Sign

SIGNATURE OF CORPORATE OFFICER

DATE

TITLE

Here

NAME OF CORPORATE OFFICER

PHONE NUMBER (with area code)

Print

General Instructions

Purpose of Form

How to Make an Election to File an Arizona Consolidated

Return

The common parent of an affiliated group that files a federal

consolidated return may elect to file an Arizona consolidated

• Complete a separate Form 122 for each subsidiary included

return. The election by the common parent is effective only if

in the federal affiliated group for the taxable year for which the

it is accompanied by written consents to the election signed by

election is made. The Form 122 for each subsidiary must be

each of the members of the affiliated group. This form is used

signed by a current officer of that subsidiary.

by each of the subsidiary corporations included in the affiliated

group to consent to the election made by the common parent.

• File all of the completed Form(s) 122 (for each subsidiary

The consent form must be signed by a current officer of each

included in the federal affiliated group) AND the tax return by

subsidiary in the affiliated group.

the due date, including extensions, for filing the original return.

NOTE: Refer to A.R.S. § 43-947 and Form 120 instructions

for further information regarding the election to file an Arizona

consolidated return.

The election must be made by the common parent on or before

the due date, including any extensions, for filing the original

return (Form 120). The completed Form(s) 122 must be included

with Form 120 filed with the department for the first taxable year

a consolidated return is filed. The consent form must be signed

by a current officer of each subsidiary in the affiliated group.

ADOR 10147 (14)

1

1