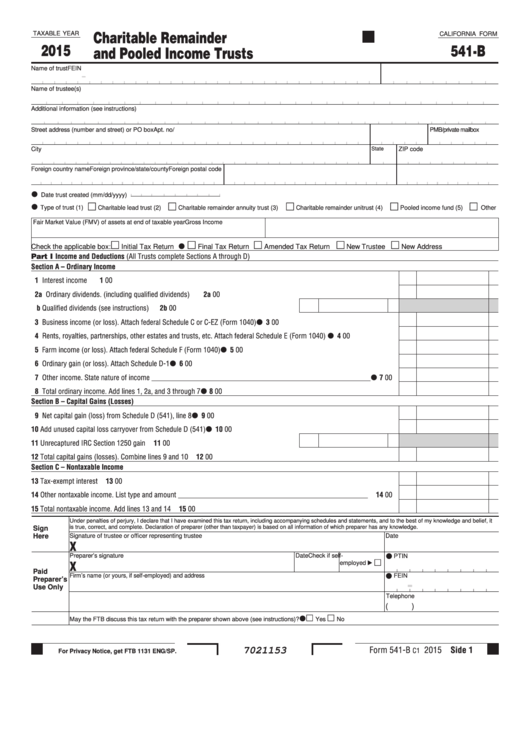

California Form 541-B - Charitable Remainder And Pooled Income Trusts - 2015

ADVERTISEMENT

Charitable Remainder

TAXABLE YEAR

CALIFORNIA FORM

2015

541-B

and Pooled Income Trusts

Name of trust

FEIN

-

Name of trustee(s)

Additional information (see instructions)

Street address (number and street) or PO box

Apt. no/ste.no.

PMB/private mailbox

City

State

ZIP code

Foreign country name

Foreign province/state/county

Foreign postal code

Date trust created (mm/dd/yyyy)

m

m

m

m

m

Type of trust (1)

Charitable lead trust (2)

Charitable remainder annuity trust (3)

Charitable remainder unitrust (4)

Pooled income fund (5)

Other

Fair Market Value (FMV) of assets at end of taxable year

Gross Income

m

m

m

m

m

Check the applicable box:

Initial Tax Return

Final Tax Return

Amended Tax Return

New Trustee

New Address

Part I

Income and Deductions (All Trusts complete Sections A through D)

Section A – Ordinary Income

1 Interest income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

00

2a Ordinary dividends . (including qualified dividends) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2a

00

b Qualified dividends (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2b

00

3 Business income (or loss) . Attach federal Schedule C or C-EZ (Form 1040) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

00

4 Rents, royalties, partnerships, other estates and trusts, etc . Attach federal Schedule E (Form 1040) . . . . . . . . . . . . . . . .

4

00

5 Farm income (or loss) . Attach federal Schedule F (Form 1040) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

00

6 Ordinary gain (or loss) . Attach Schedule D-1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

00

7 Other income . State nature of income ____________________________________________________________ . . . .

7

00

8 Total ordinary income . Add lines 1, 2a, and 3 through 7 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

00

Section B – Capital Gains (Losses)

9 Net capital gain (loss) from Schedule D (541), line 8 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

00

10 Add unused capital loss carryover from Schedule D (541) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10

00

11 Unrecaptured IRC Section 1250 gain . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11

00

12 Total capital gains (losses) . Combine lines 9 and 10 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12

00

Section C – Nontaxable Income

13 Tax-exempt interest . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13

00

14 Other nontaxable income . List type and amount ____________________________________________________ . . . . . .

14

00

15 Total nontaxable income . Add lines 13 and 14 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

15

00

Under penalties of perjury, I declare that I have examined this tax return, including accompanying schedules and statements, and to the best of my knowledge and belief, it

is true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Sign

Here

Signature of trustee or officer representing trustee

Date

X

Preparer’s signature

Date

Check if self-

PTIN

m

X

employed

Paid

Firm’s name (or yours, if self-employed) and address

FEIN

Preparer’s

-

Use Only

Telephone

(

)

m

m

May the FTB discuss this tax return with the preparer shown above (see instructions)?. . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

Form 541-B

2015 Side 1

C1

7021153

For Privacy Notice, get FTB 1131 ENG/SP.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6