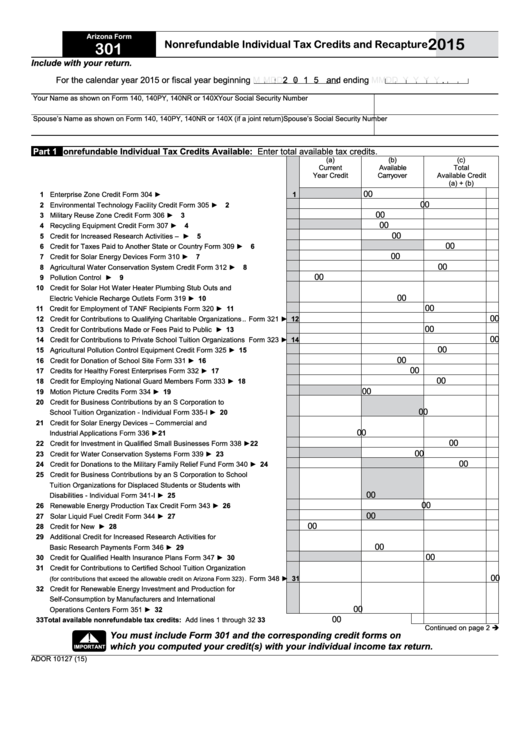

Arizona Form

2015

Nonrefundable Individual Tax Credits and Recapture

301

Include with your return.

For the calendar year 2015 or fiscal year beginning

M M D D

2 0 1 5 and ending

M M D D Y Y Y Y

.

Your Name as shown on Form 140, 140PY, 140NR or 140X

Your Social Security Number

Spouse’s Name as shown on Form 140, 140PY, 140NR or 140X (if a joint return)

Spouse’s Social Security Number

Part 1

Nonrefundable Individual Tax Credits Available: Enter total available tax credits.

(a)

(b)

(c)

Current

Available

Total

Year Credit

Carryover

Available Credit

(a) + (b)

00

1 Enterprise Zone Credit ................................................................ Form 304 ►

1

00

2 Environmental Technology Facility Credit .................................... Form 305 ►

2

00

3 Military Reuse Zone Credit .......................................................... Form 306 ►

3

00

4 Recycling Equipment Credit ........................................................ Form 307 ►

4

00

5 Credit for Increased Research Activities – Individuals............... Form 308-I ►

5

00

6 Credit for Taxes Paid to Another State or Country ....................... Form 309 ►

6

00

7 Credit for Solar Energy Devices .................................................. Form 310 ►

7

00

8 Agricultural Water Conservation System Credit .......................... Form 312 ►

8

00

9 Pollution Control Credit................................................................ Form 315 ►

9

10 Credit for Solar Hot Water Heater Plumbing Stub Outs and

00

Electric Vehicle Recharge Outlets ............................................... Form 319 ► 10

00

11 Credit for Employment of TANF Recipients ................................. Form 320 ► 11

00

12 Credit for Contributions to Qualifying Charitable Organizations .. Form 321 ► 12

00

13 Credit for Contributions Made or Fees Paid to Public Schools.... Form 322 ► 13

00

14 Credit for Contributions to Private School Tuition Organizations Form 323 ► 14

00

15 Agricultural Pollution Control Equipment Credit .......................... Form 325 ► 15

00

16 Credit for Donation of School Site ............................................... Form 331 ► 16

00

17 Credits for Healthy Forest Enterprises ........................................ Form 332 ► 17

00

18 Credit for Employing National Guard Members ........................... Form 333 ► 18

00

19 Motion Picture Credits ................................................................. Form 334 ► 19

20 Credit for Business Contributions by an S Corporation to

00

School Tuition Organization - Individual .................................... Form 335-I ► 20

21 Credit for Solar Energy Devices – Commercial and

00

Industrial Applications .................................................................. Form 336 ► 21

00

22 Credit for Investment in Qualified Small Businesses ................... Form 338 ► 22

00

23 Credit for Water Conservation Systems ...................................... Form 339 ► 23

00

24 Credit for Donations to the Military Family Relief Fund ............... Form 340 ► 24

25 Credit for Business Contributions by an S Corporation to School

Tuition Organizations for Displaced Students or Students with

00

Disabilities - Individual ............................................................... Form 341-I ► 25

00

26 Renewable Energy Production Tax Credit ................................... Form 343 ► 26

00

27 Solar Liquid Fuel Credit ............................................................... Form 344 ► 27

00

28 Credit for New Employment......................................................... Form 345 ► 28

29 Additional Credit for Increased Research Activities for

00

Basic Research Payments .......................................................... Form 346 ► 29

00

30 Credit for Qualified Health Insurance Plans ................................ Form 347 ► 30

31 Credit for Contributions to Certified School Tuition Organization

00

. Form 348 ► 31

(for contributions that exceed the allowable credit on Arizona Form 323)

32 Credit for Renewable Energy Investment and Production for

Self-Consumption by Manufacturers and International

00

Operations Centers ..................................................................... Form 351 ► 32

00

33 Total available nonrefundable tax credits: Add lines 1 through 32 ............................................................................. 33

Continued on page 2

!

You must include Form 301 and the corresponding credit forms on

which you computed your credit(s) with your individual income tax return.

IMPORTANT

ADOR 10127 (15)

1

1 2

2