Iowa Department of Revenue

https://tax.iowa.gov

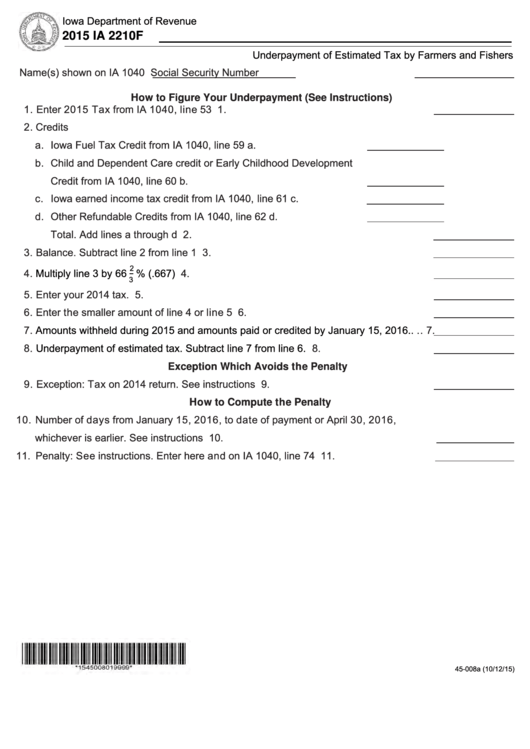

2015 IA 2210F

Underpayment of Estimated Tax by Farmers and Fishers

Name(s) shown on IA 1040

Social Security Number

How to Figure Your Underpayment (See Instructions)

1. Enter 2015 Tax from IA 1040, line 53 ............................................................. 1.

2. Credits

a. Iowa Fuel Tax Credit from IA 1040, line 59 ..................................a.

b. Child and Dependent Care credit or Early Childhood Development

Credit from IA 1040, line 60 ........................................................b.

c. Iowa earned income tax credit from IA 1040, line 61 ...................c.

d. Other Refundable Credits from IA 1040, line 62 ..........................d.

Total. Add lines a through d ............................................................................. 2.

3. Balance. Subtract line 2 from line 1 ....................................................................... 3.

2

4.

Multiply line 3 by 66

% (.667)

.......................................................................... 4.

3

5. Enter your 2014 tax. ...................................................................................... 5.

6. Enter the smaller amount of line 4 or line 5 ..................................................... 6.

7.

Amounts withheld during 2015 and amounts paid or credited by January 15, 2016..

.. 7.

8.

Underpayment of estimated tax. Subtract line 7 from line 6.

.................................. 8.

Exception Which Avoids the Penalty

9. Exception: Tax on 2014 return. See instructions ............................................. 9.

How to Compute the Penalty

10. Number of days from January 15, 2016, to date of payment or April 30, 2016,

whichever is earlier. See instructions ............................................................ 10.

11. Penalty: See instructions. Enter here and on IA 1040, line 74 ............................... 11.

45-008a (10/12/15)

1

1 2

2