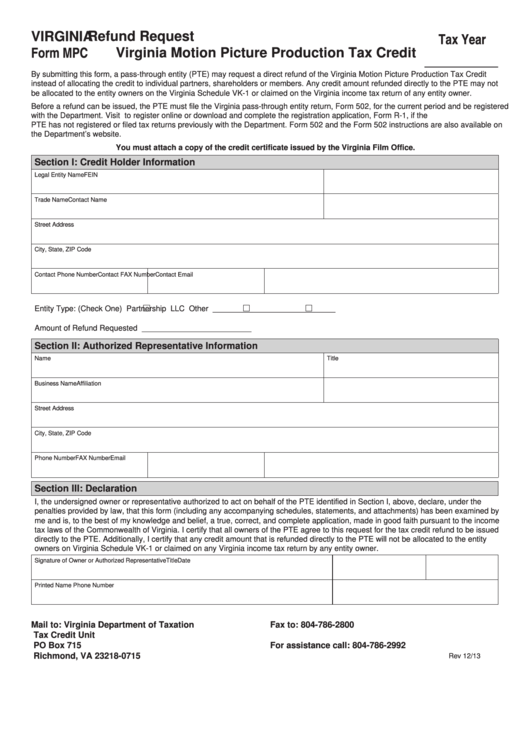

Refund Request

VIRGINIA

Tax Year

Form MPC

Virginia Motion Picture Production Tax Credit

___________

By submitting this form, a pass-through entity (PTE) may request a direct refund of the Virginia Motion Picture Production Tax Credit

instead of allocating the credit to individual partners, shareholders or members. Any credit amount refunded directly to the PTE may not

be allocated to the entity owners on the Virginia Schedule VK-1 or claimed on the Virginia income tax return of any entity owner.

Before a refund can be issued, the PTE must file the Virginia pass-through entity return, Form 502, for the current period and be registered

with the Department. Visit to register online or download and complete the registration application, Form R-1, if the

PTE has not registered or filed tax returns previously with the Department. Form 502 and the Form 502 instructions are also available on

the Department’s website.

You must attach a copy of the credit certificate issued by the Virginia Film Office.

Section I: Credit Holder Information

Legal Entity Name

FEIN

Trade Name

Contact Name

Street Address

City, State, ZIP Code

Contact Phone Number

Contact FAX Number

Contact Email

Entity Type: (Check One)

Partnership

LLC

Other ____________________________

Amount of Refund Requested _________________________

Section II: Authorized Representative Information

Name

Title

Business Name

Affiliation

Street Address

City, State, ZIP Code

Phone Number

FAX Number

Email

Section III: Declaration

I, the undersigned owner or representative authorized to act on behalf of the PTE identified in Section I, above, declare, under the

penalties provided by law, that this form (including any accompanying schedules, statements, and attachments) has been examined by

me and is, to the best of my knowledge and belief, a true, correct, and complete application, made in good faith pursuant to the income

tax laws of the Commonwealth of Virginia. I certify that all owners of the PTE agree to this request for the tax credit refund to be issued

directly to the PTE. Additionally, I certify that any credit amount that is refunded directly to the PTE will not be allocated to the entity

owners on Virginia Schedule VK-1 or claimed on any Virginia income tax return by any entity owner.

Signature of Owner or Authorized Representative

Title

Date

Printed Name

Phone Number

Mail to: Virginia Department of Taxation

Fax to: 804-786-2800

Tax Credit Unit

PO Box 715

For assistance call: 804-786-2992

Richmond, VA 23218-0715

Rev 12/13

1

1