Clear Form

__

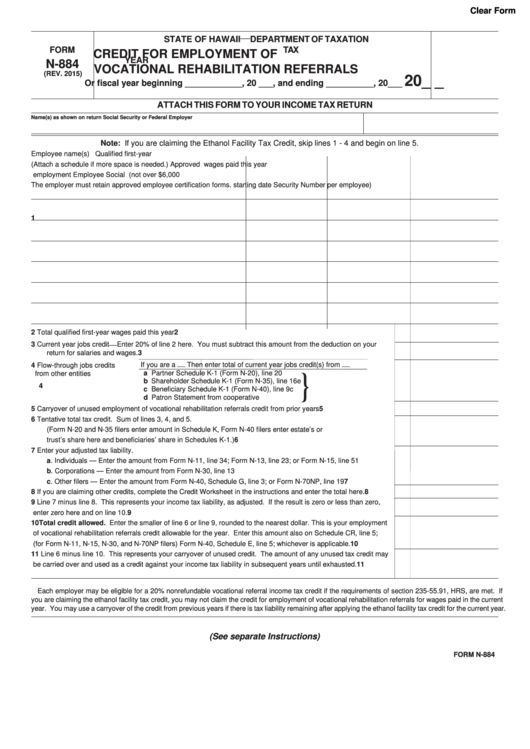

STATE OF HAWAII

DEPARTMENT OF TAXATION

FORM

TAX

CREDIT FOR EMPLOYMENT OF

YEAR

N-884

VOCATIONAL REHABILITATION REFERRALS

(REV. 2015)

20_ _

Or fiscal year beginning ____________, 20 ___, and ending __________, 20___

ATTACH THIS FORM TO YOUR INCOME TAX RETURN

Name(s) as shown on return

Social Security or Federal Employer I.D. Number

Note: If you are claiming the Ethanol Facility Tax Credit, skip lines 1 - 4 and begin on line 5.

Employee name(s)

Qualified first-year

(Attach a schedule if more space is needed.)

Approved

wages paid this year

employment

Employee Social

(not over $6,000

The employer must retain approved employee certification forms.

starting date

Security Number

per employee)

1

2

Total qualified first-year wages paid this year ............................................................................................................

2

Current year jobs credit __ Enter 20% of line 2 here. You must subtract this amount from the deduction on your

3

return for salaries and wages. ...................................................................................................................................

3

If you are a __

Then enter total of current year jobs credit(s) from __

4

Flow-through jobs credits

a Partner ............

Schedule K-1 (Form N-20), line 20 ....................

from other entities

}

b Shareholder ....

Schedule K-1 (Form N-35), line 16e ..................

.......

4

c Beneficiary ......

Schedule K-1 (Form N-40), line 9c ....................

d Patron .............

Statement from cooperative ...............................

5

Carryover of unused employment of vocational rehabilitation referrals credit from prior years .................................

5

6

Tentative total tax credit. Sum of lines 3, 4, and 5.

(Form N-20 and N-35 filers enter amount in Schedule K, Form N-40 filers enter estate’s or

trust’s share here and beneficiaries’ share in Schedules K-1.) ..................................................................................

6

7

Enter your adjusted tax liability.

a. Individuals — Enter the amount from Form N-11, line 34; Form N-13, line 23; or Form N-15, line 51 ..................

b. Corporations — Enter the amount from Form N-30, line 13 ..................................................................................

c. Other filers — Enter the amount from Form N-40, Schedule G, line 3; or Form N-70NP, line 19 ..........................

7

8

If you are claiming other credits, complete the Credit Worksheet in the instructions and enter the total here. .........

8

9

Line 7 minus line 8. This represents your income tax liability, as adjusted. If the result is zero or less than zero,

enter zero here and on line 10. ..................................................................................................................................

9

10

Total credit allowed. Enter the smaller of line 6 or line 9, rounded to the nearest dollar. This is your employment

of vocational rehabilitation referrals credit allowable for the year. Enter this amount also on Schedule CR, line 5;

(for Form N-11, N-15, N-30, and N-70NP filers) Form N-40, Schedule E, line 5; whichever is applicable. ............... 10

11

Line 6 minus line 10. This represents your carryover of unused credit. The amount of any unused tax credit may

be carried over and used as a credit against your income tax liability in subsequent years until exhausted. ........... 11

Each employer may be eligible for a 20% nonrefundable vocational referral income tax credit if the requirements of section 235-55.91, HRS, are met. If

you are claiming the ethanol facility tax credit, you may not claim the credit for employment of vocational rehabilitation referrals for wages paid in the current

year. You may use a carryover of the credit from previous years if there is tax liability remaining after applying the ethanol facility tax credit for the current year.

(See separate Instructions)

FORM N-884

1

1