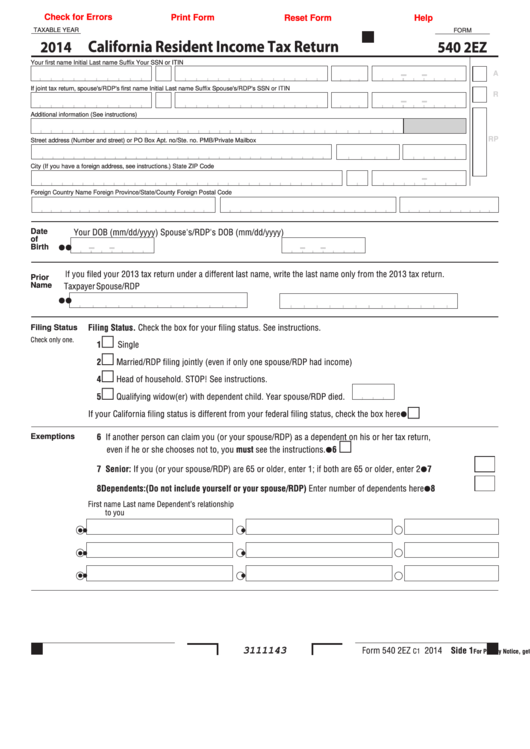

Check for Errors

Help

Print Form

Reset Form

TAXABLE YEAR

FORM

California Resident Income Tax Return

2014

540 2EZ

Your first name

Initial Last name

Suffix

Your SSN or ITIN

A

If joint tax return, spouse's/RDP's first name

Initial Last name

Suffix

Spouse's/RDP's SSN or ITIN

R

Additional information (See instructions)

RP

Street address (Number and street) or PO Box

Apt. no/Ste. no.

PMB/Private Mailbox

City (If you have a foreign address, see instructions.)

State

ZIP Code

Foreign Country Name

Foreign Province/State/County

Foreign Postal Code

Your DOB (mm/dd/yyyy)

Spouse's/RDP's DOB (mm/dd/yyyy)

Date

of

Birth

If you filed your 2013 tax return under a different last name, write the last name only from the 2013 tax return.

Prior

Taxpayer

Spouse/RDP

Name

Filing Status. Check the box for your filing status. See instructions.

Filing Status

m

Check only one.

1

Single

m

2

Married/RDP filing jointly (even if only one spouse/RDP had income)

m

4

Head of household. STOP! See instructions.

m

5

Qualifying widow(er) with dependent child. Year spouse/RDP died.

m

If your California filing status is different from your federal filing status, check the box here . . . . . . . . . .

6 If another person can claim you (or your spouse/RDP) as a dependent on his or her tax return,

Exemptions

m

even if he or she chooses not to, you must see the instructions. . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

7 Senior: If you (or your spouse/RDP) are 65 or older, enter 1; if both are 65 or older, enter 2 . . . . . .

7

8 Dependents: (Do not include yourself or your spouse/RDP) Enter number of dependents here. . . .

8

First name

Last name

Dependent’s relationship

to you

Form 540 2EZ

2014 Side 1

C1

3111143

For Privacy Notice, get FTB 1131 ENG/SP.

1

1 2

2 3

3 4

4