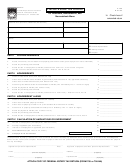

Form K-706 - Kansas Estate Tax Return For Deaths Occurring In 2007, 2008 And 2009 Page 16

ADVERTISEMENT

Estate of:

______________________________________________________________________________________

K-706 (Rev. 1/07)

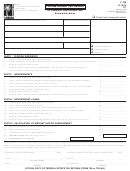

KANSAS SCHEDULE M – Bequests, etc. to Surviving Spouse

Election to Deduct Qualified Terminable Interest Property. If a trust (or other property) meets the requirements of

qualified terminable interest property and

a. The trust or other property is listed on Schedule M; and,

b. The value of the trust (or other property) is entered in whole or in part as a deduction on Schedule M, then unless the

executor specifically identifies the trust (all or a fractional portion or percentage) or other property to be excluded from

the election, the executor shall be deemed to have made an election to have such trust (or other property) treated as

qualified terminable interest property.

If less than the entire value of the trust (or other property) that the executor has included in the gross estate is entered as a

deduction on Schedule M, the executor shall be considered to have made an election only as to a fraction of the trust (or other

property). The numerator of this fraction is equal to the amount of the trust (or other property) deducted on Schedule M. The

denominator is equal to the total value of the trust (or other property).

1

Did any property pass to the surviving spouse as a result of a qualified disclaimer? (If Yes, attach

a court certified copy of the written disclaimer) ............................................................................

Yes

No

2

Election Out of QTIP Treatment of Annuities - Do you elect not to treat as a qualified terminable

interest property any joint and survivor annuities that are included in the gross estate and would

otherwise be treated as qualified terminable interest property? (See Instructions) ........................

Yes

No

ITEM

DESCRIPTION OF PROPERTY INTERESTS PASSING TO SURVIVING SPOUSE

AMOUNT

NUMBER

Total from additional sheets attached to this schedule .............................................................................

3

3 Total amount of property interests listed on Schedule M ...............................................................

4a

4a Federal estate taxes payable out of property interests listed on Schedule M

4b Other death taxes payable out of property interests listed on Schedule M

4b

4c Federal and state GST taxes payable out of property interests listed on

4c

Schedule M ................................................................................................

4d

4d Add items 4a, 4b, and 4c ..............................................................................................................

5

Net amount of property interests listed on Schedule M (subtract line 4d from line 3). Also enter

5

under the Recapitulation, page 2, line 27 ......................................................................................

(If more space is needed, insert additional sheets of same size)

15

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19