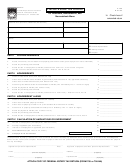

Form K-706 - Kansas Estate Tax Return For Deaths Occurring In 2007, 2008 And 2009 Page 9

ADVERTISEMENT

Estate of:

______________________________________________________________________________________

K-706 (Rev. 1/07)

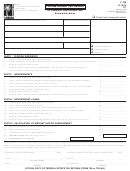

KANSAS SCHEDULE F – Other Miscellaneous Property

• Jointly owned property should be reported on Schedule E.

1. Did the decedent, at the time of death, own any articles or collections having either artistic

or intrinsic value, such as jewelry, furs, paintings, antiques, rare books, coins or stamps?

(If Yes, full details must be submitted with this schedule) ......................................................

Yes

No

2. Has the decedent’s estate, spouse, or any other person received (or will receive) any bonus

or award as a result of the decedent’s employment or death? (If Yes, full details must be

submitted with this schedule) ................................................................................................

Yes

No

3. Did the decedent at the time of death have a safety deposit box? (If Yes, state the location

and, if held in joint names of decedent and another, state the name and relationship of joint

depositor) ..............................................................................................................................

Yes

No

If any of the contents of the safety deposit box are omitted from the schedules in this return,

explain fully why omitted: ___________________________________________________

_______________________________________________________________________

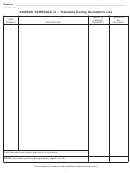

VALUE OF

VALUE OF

ITEM

KANSAS

ALL

DESCRIPTION

NUMBER

PROPERTY

PROPERTY

1

Total from additional sheets attached to this schedule ................................................

TOTAL (Also enter under the Recapitulation, page 2, line 15) ....................................

(If more space is needed, insert additional sheets of same size)

8

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19