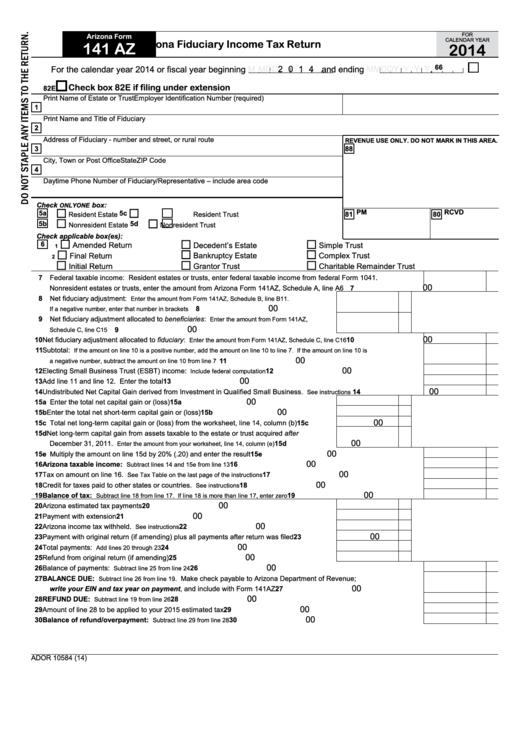

FOR

Arizona Form

CALENDAR YEAR

Arizona Fiduciary Income Tax Return

141 AZ

2014

66

For the calendar year 2014 or fiscal year beginning

M M D D

2 0 1 4 and ending

M M D D Y Y Y Y

.

Check box 82E if filing under extension

82E

Print Name of Estate or Trust

Employer Identification Number (required)

1

Print Name and Title of Fiduciary

2

Address of Fiduciary - number and street, or rural route

REVENUE USE ONLY. DO NOT MARK IN THIS AREA.

3

88

City, Town or Post Office

State

ZIP Code

4

Daytime Phone Number of Fiduciary/Representative – include area code

Check

box:

only one

81 PM

80 RCVD

5a

5c

Resident Estate

Resident Trust

5b

5d

Nonresident Estate

Nonresident Trust

Check applicable box(es):

6

Amended Return

Decedent’s Estate

Simple Trust

1

Final Return

Bankruptcy Estate

Complex Trust

2

Initial Return

Grantor Trust

Charitable Remainder Trust

7

Federal taxable income: Resident estates or trusts, enter federal taxable income from federal Form 1041.

00

Nonresident estates or trusts, enter the amount from Arizona Form 141AZ, Schedule A, line A6 ................................... 7

8

Net fiduciary adjustment:

Enter the amount from Form 141AZ, Schedule B, line B11.

00

.....................................................................

8

If a negative number, enter that number in brackets

9

Net fiduciary adjustment allocated to beneficiaries:

Enter the amount from Form 141AZ,

00

..............................................................................................................

9

Schedule C, line C15

00

10

Net fiduciary adjustment allocated to fiduciary:

............................. 10

Enter the amount from Form 141AZ, Schedule C, line C16

11

Subtotal:

If the amount on line 10 is a positive number, add the amount on line 10 to line 7. If the amount on line 10 is

00

.................................................................................................... 11

a negative number, subtract the amount on line 10 from line 7

00

12

Electing Small Business Trust (ESBT) income:

........................................................................ 12

Include federal computation

00

13

Add line 11 and line 12. Enter the total ............................................................................................................................ 13

00

14

Undistributed Net Capital Gain derived from Investment in Qualified Small Business.

........................... 14

See instructions

00

15a Enter the total net capital gain or (loss) .............................................................................. 15a

00

15b Enter the total net short-term capital gain or (loss) ............................................................. 15b

00

15c Total net long-term capital gain or (loss) from the worksheet, line 14, column (b) .............. 15c

15d Net long-term capital gain from assets taxable to the estate or trust acquired after

00

......................... 15d

December 31, 2011.

Enter the amount from your worksheet, line 14, column (e)

00

15e Multiply the amount on line 15d by 20% (.20) and enter the result ................................................................................... 15e

00

16

Arizona taxable income:

......................................................................................... 16

Subtract lines 14 and 15e from line 13

00

17

Tax on amount on line 16.

.......................................................................... 17

See Tax Table on the last page of the instructions

00

18

..................................................................................... 18

Credit for taxes paid to other states or countries.

See instructions

00

19

Balance of tax:

............................................................ 19

Subtract line 18 from line 17. If line 18 is more than line 17, enter zero

00

20

Arizona estimated tax payments ......................................................................................... 20

00

21

Payment with extension ...................................................................................................... 21

00

22

...................................................................... 22

Arizona income tax withheld.

See instructions

00

23

Payment with original return (if amending) plus all payments after return was filed ........... 23

00

24

Total payments:

............................................................................... 24

Add lines 20 through 23

00

25

Refund from original return (if amending) ........................................................................... 25

00

26

.............................................................................................................. 26

Balance of payments:

Subtract line 25 from line 24

27

BALANCE DUE:

Make check payable to Arizona Department of Revenue;

Subtract line 26 from line 19.

00

write your EIN and tax year on payment, and include with Form 141AZ ...................................................................... 27

00

28

REFUND DUE:

........................................................................................................................ 28

Subtract line 19 from line 26

00

29

Amount of line 28 to be applied to your 2015 estimated tax ............................................................................................. 29

00

30

Balance of refund/overpayment:

.......................................................................................... 30

Subtract line 29 from line 28

ADOR 10584 (14)

1

1 2

2 3

3 4

4