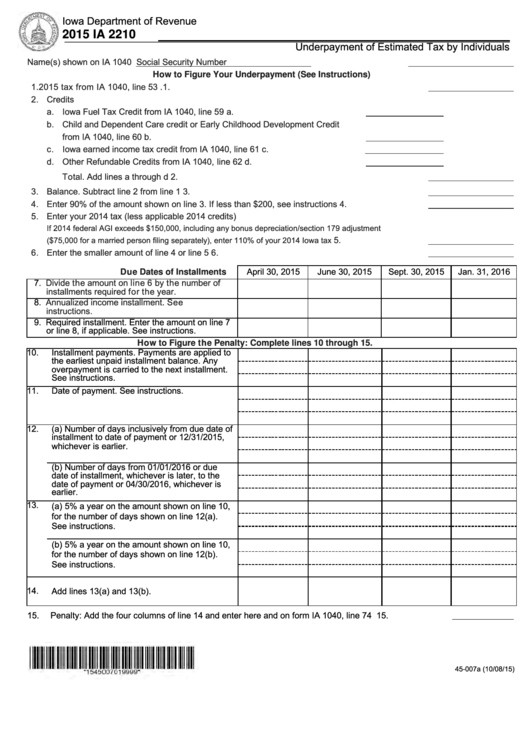

Iowa Department of Revenue

https://tax.iowa.gov

2015 IA 2210

Underpayment of Estimated Tax by Individuals

Name(s) shown on IA 1040

Social Security Number

How to Figure Your Underpayment (See Instructions)

1. 2015 tax from IA 1040, line 53 .................................................................................................1.

2. Credits

a. Iowa Fuel Tax Credit from IA 1040, line 59 ................................................a.

b. Child and Dependent Care credit or Early Childhood Development Credit

from IA 1040, line 60 .................................................................................b.

c. Iowa earned income tax credit from IA 1040, line 61 ..................................c.

d. Other Refundable Credits from IA 1040, line 62 .........................................d.

Total. Add lines a through d ...............................................................................................2.

3. Balance. Subtract line 2 from line 1 .........................................................................................3.

4. Enter 90% of the amount shown on line 3. If less than $200, see instructions ..........................4.

5. Enter your 2014 tax (less applicable 2014 credits)

If 2014 federal AGI exceeds $150,000, including any bonus depreciation/section 179 adjustment

.............................5.

($75,000 for a married person filing separately), enter 110% of your 2014 Iowa tax

6. Enter the smaller amount of line 4 or line 5 ..............................................................................6.

April 30, 2015

June 30, 2015

Sept. 30, 2015

Jan. 31, 2016

Due Dates of Installments

7.

Divide the amount on line 6 by the number of

installments required for the year.

8.

Annualized income installment. See

instructions.

9. Required installment. Enter the amount on line 7

or line 8, if applicable. See instructions.

How to Figure the Penalty: Complete lines 10 through 15.

10.

Installment payments. Payments are applied to

the earliest unpaid installment balance. Any

overpayment is carried to the next installment.

See instructions.

11.

Date of payment. See instructions.

12.

(a) Number of days inclusively from due date of

installment to date of payment or 12/31/2015,

whichever is earlier.

(b) Number of days from 01/01/2016 or due

date of installment, whichever is later, to the

date of payment or 04/30/2016, whichever is

earlier.

13.

(a) 5% a year on the amount shown on line 10,

for the number of days shown on line 12(a).

See instructions.

(b) 5% a year on the amount shown on line 10,

for the number of days shown on line 12(b).

See instructions.

14.

Add lines 13(a) and 13(b).

15.

Penalty: Add the four columns of line 14 and enter here and on form IA 1040, line 74 ........................... 15.

45-007a (10/08/15)

1

1 2

2 3

3