TM

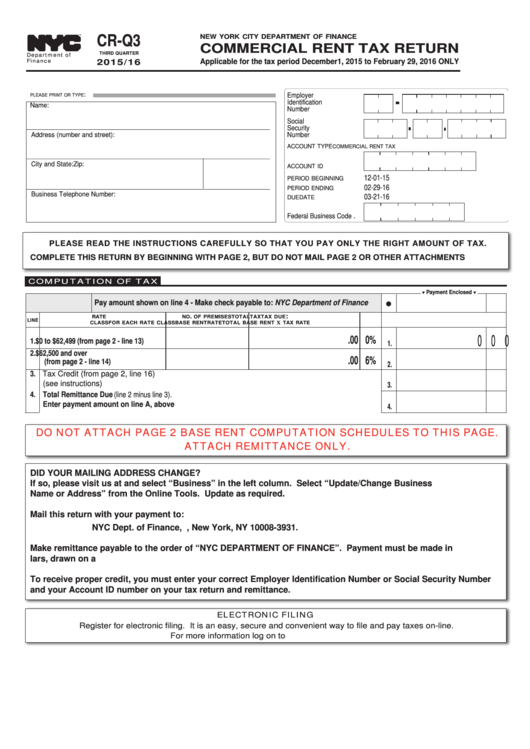

CR-Q3

NEW YORK CITY DEPARTMENT OF FINANCE

COMMERCIAL RENT TAX RETURN

Department of

Finance

THIRD QUARTER

Applicable for the tax period December 1, 2015 to February 29, 2016 ONLY

2015/16

Employer

Identification

:

Name:

PLEASE PRINT OR TYPE

Number .............................

Social

Security

_________________________________________________________________________________

Number....................

Address (number and street):

ACCOUNT TYPE

COMMERCIAL RENT TAX

..........

_________________________________________________________________________________

...............

City and State:

Zip:

ACCOUNT ID

12-01-15

......

PERIOD BEGINNING

..........

02-29-16

_________________________________________________________________________________

PERIOD ENDING

Business Telephone Number:

03-21-16

....................

DUE DATE

.

Federal Business Code

PLEASE READ THE INSTRUCTIONS CAREFULLY SO THAT YOU PAY ONLY THE RIGHT AMOUNT OF TAX.

COMPLETE THIS RETURN BY BEGINNING WITH PAGE 2, BUT DO NOT MAIL PAGE 2 OR OTHER ATTACHMENTS

COMPUTATION OF TAX

t

t

Payment Enclosed

l

A. Payment -

Pay amount shown on line 4 - Make check payable to: NYC Department of Finance

0 0 0

.

:

RATE

NO

OF PREMISES

TOTAL

TAX

TAX DUE

LINE

.00 0%

CLASS

FOR EACH RATE CLASS

BASE RENT

RATE

TOTAL BASE RENT

TAX RATE

1.

$0 to $62,499 (from page 2 - line 13)

1.

2.

$62,500 and over

.00 6%

(from page 2 - line 14)

2.

3. Tax Credit (from page 2, line 16)

3.

4. Total Remittance Due (line 2 minus line 3).

(see instructions) ...........................................................................................................................

4.

Enter payment amount on line A, above ..........................................................................................

DO NOT ATTACH PAGE 2 BASE RENT COMPUTATION SCHEDULES TO THIS PAGE.

ATTACH REMITTANCE ONLY.

DID YOUR MAILING ADDRESS CHANGE?

If so, please visit us at nyc.gov/finance and select “Business” in the left column. Select “Update/Change Business

Name or Address” from the Online Tools. Update as required.

Mail this return with your payment to:

NYC Dept. of Finance, P.O. Box 3931, New York, NY 10008-3931.

Make remittance payable to the order of “NYC DEPARTMENT OF FINANCE”. Payment must be made in U.S. dol-

lars, drawn on a U.S. bank.

To receive proper credit, you must enter your correct Employer Identification Number or Social Security Number

and your Account ID number on your tax return and remittance.

ELECTRONIC FILING

Register for electronic filing. It is an easy, secure and convenient way to file and pay taxes on-line.

For more information log on to nyc.gov/eservices

1

1 2

2