*DO=NOT=SEND*

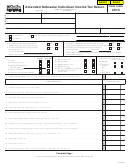

DR 0112X (09/22/15)

COLORADO DEPARTMENT OF REVENUE

Denver CO 80261-0006

Instructions

Statute of Limitations. The statute of limitations for filing

The 2015 Form 112X, Amended C Corporation Income Tax

Return, is used to correct your 2015 Corporation income

a Colorado claim for refund is generally four years from the

tax return. File the return for free using Revenue Online.

original due date of the return or three years from the date

You can file on paper if you cannot file electronically,

of the last payment of tax or the year involved, whichever

but please note that filing on paper can increase return

is later. In the case of an investment credit or capital loss

carryback, the claim must be filed within four years of the

problems and delay refunds. For more information or any

questions pertaining to income, deductions, modifications,

due date of the return for the year during which the credit or

credits, etc., refer to the income tax book for 2015 or call

loss arose. See FYI General 18.

the Department of Revenue at 303-238-SERV (7378).You

Colorado net operating losses may not be carried back

can also obtain forms, information and the FYIs referenced

to an earlier year. They may be carried forward for 15 years

herein online at

from tax years beginning before August 6, 1997, and 20

Attachments: Attach all required schedules and supporting

years from tax years beginning on or after August 6, 1997.

certifications to this amended return even if there is no

Protective Claims. If this amended return is being filed to

change from the original return. (For example: Schedule

keep the statute of limitations open pending the outcome

SF, Form 112CR, DR 0074, etc.) Failure to attach this

of a court case or tax determination in another state that

documentation will result in the disallowance of credits,

affects your Colorado return, check the protective claim box

subtractions or reduced apportioned income.

under reason for filing corrected return.

Lines 35 through 41 compute the amount you owe to the

Payment

state on the amended return. Any decrease in the amount

Taxpayers can now visit

of the overpayment (line 35) or increase in the amount

to pay online. Online payments reduce errors and provide

owed (line 36) will indicate that an amount is owed with

instant payment confirmation. Revenue Online also allows

the amended return. See FYI General 11 for assistance in

users to submit various forms and to monitor their tax

computing the amount of interest to enter on line 38. If you

account. Please be advised that a nominal processing fee

have previously been assessed a delinquency penalty or

may apply to electronic payments.

estimated tax penalty and this amended return causes the

If you are unable to remit electronically, make your check

amount of penalty to change, enter the increased penalties

payable to the Colorado Department of Revenue and mail it to:

on lines 39 and/or 40.

Colorado Department of Revenue

Lines 42 through 46 compute your refund of credit

Denver CO 80261-0006

available on the amended return. Any increase in the

amount of the overpayment (line 42) or decrease in the

If you are not submitting your return electronically, please

amount owed (line 43) will indicate that an overpayment

use form DR 0900C to remit your payment. Otherwise, your

is available with the amended return. The overpayment

account might not be properly credited.

can be credited to estimated tax (line 45) for the tax year

following the period on the amended return, or can be

requested as a refund (line 46).

Manage your account.

File and pay online.

Get started with Revenue Online today!

1

1 2

2 3

3 4

4 5

5