Form 740np-Wh-Es - Pass-Through Entity Nonresident Distributive Share Withholding Report And Composite Income Tax Return Voucher - 2016

ADVERTISEMENT

740NP-WH-ES

Page 1

40A201ES (10-15)

Commonwealth of Kentucky

DEPARTMENT OF REVENUE

INSTRUCTIONS – 2016 PASS-THROUGH ENTITY NONRESIDENT

DISTRIBUTIVE SHARE WITHHOLDING REPORT AND COMPOSITE

INCOME TAX RETURN VOUCHER

Who Must File—Effective for taxable years beginning after December 31, 2011, every pass-through entity required to

withhold Kentucky income tax as provided by KRS 141.206(5) or that files a composite income tax return as provided

by KRS 141.206(16)(a) shall make a declaration and payments of estimated tax as required by KRS 141.206(6) if: (i)

a nonresident individual partner’s, member’s or shareholder’s estimated tax liability can reasonably be expected to

exceed $500; or (ii) a corporate partner’s or member’s estimated tax liability can reasonably be expected to exceed

$5,000.

KRS 141.206(5) provides that every pass-through entity required to file a return under KRS 141.206(2), except publicly

traded partnerships as defined in KRS 141.0401(6)(r), shall withhold Kentucky income tax on the distributive share,

whether distributed or undistributed, of each: (i) nonresident individual partner, member or shareholder; and (ii)

corporate partner or member that is doing business in Kentucky only through its ownership interest in a pass-through

entity. Withholding shall be at the maximum rate provided by KRS 141.020 or 141.040.

KRS 141.206(16)(a) provides that a pass-through entity may file a composite income tax return on behalf of qualifying

electing nonresident individual partners, members or shareholders. The pass-through entity shall report and pay tax

at the maximum rate provided by KRS 141.020 on any portion of a partner’s, member’s or shareholder’s pro rata or

distributive share income of the pass-through entity apportioned to this state.

Payment Dates for Calendar Year Filers—KRS 141.207(2) provides that the declaration of estimated tax required under

KRS 141.207 shall be filed with the department by the pass-through entity in the same manner and at the same times

as provided by: (i) KRS 141.300, for a nonresident individual partner, member or shareholder; and (ii) KRS 141.042,

for a corporate partner or member.

MAKE CHECK PAYABLE TO: KENTUCKY STATE TREASURER

MAIL TO: KENTUCKY DEPARTMENT OF REVENUE, FRANKFORT, KENTUCKY 40619-0006

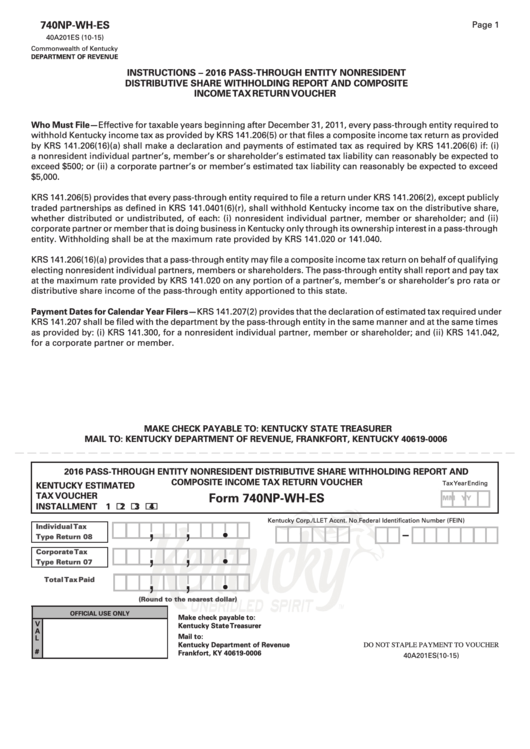

2016 PASS-THROUGH ENTITY NONRESIDENT DISTRIBUTIVE SHARE WITHHOLDING REPORT AND

COMPOSITE INCOME TAX RETURN VOUCHER

Tax Year Ending

KENTUCKY ESTIMATED

TAX VOUCHER

Form 740NP-WH-ES

M M Y

Y

INSTALLMENT 1 ¨ 2 ¨ 3 ¨ 4 ¨

,

,

Kentucky Corp./LLET Accnt. No.

Federal Identification Number (FEIN)

Individual Tax

–

l

Type Return 08

,

,

Corporate Tax

Type Return 07

l

,

,

Total Tax Paid

l

(Round to the nearest dollar)

OFFICIAL USE ONLY

Make check payable to:

V

Kentucky State Treasurer

A

Mail to:

L

Kentucky Department of Revenue

DO NOT STAPLE PAYMENT TO VOUCHER

#

Frankfort, KY 40619-0006

40A201ES(10-15)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2