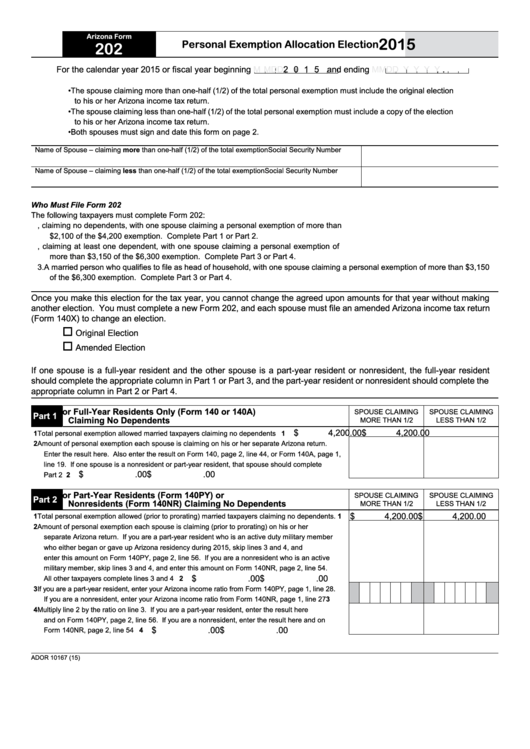

Arizona Form

2015

Personal Exemption Allocation Election

202

For the calendar year 2015 or fiscal year beginning

M M D D

2 0 1 5 and ending

M M D D Y Y Y Y

.

• The spouse claiming more than one-half (1/2) of the total personal exemption must include the original election

to his or her Arizona income tax return.

• The spouse claiming less than one-half (1/2) of the total personal exemption must include a copy of the election

to his or her Arizona income tax return.

• Both spouses must sign and date this form on page 2.

Name of Spouse – claiming more than one-half (1/2) of the total exemption

Social Security Number

Name of Spouse – claiming less than one-half (1/2) of the total exemption

Social Security Number

Who Must File Form 202

The following taxpayers must complete Form 202:

1. Married taxpayers filing separate returns, claiming no dependents, with one spouse claiming a personal exemption of more than

$2,100 of the $4,200 exemption. Complete Part 1 or Part 2.

2. Married taxpayers filing separate returns, claiming at least one dependent, with one spouse claiming a personal exemption of

more than $3,150 of the $6,300 exemption. Complete Part 3 or Part 4.

3. A married person who qualifies to file as head of household, with one spouse claiming a personal exemption of more than $3,150

of the $6,300 exemption. Complete Part 3 or Part 4.

Once you make this election for the tax year, you cannot change the agreed upon amounts for that year without making

another election. You must complete a new Form 202, and each spouse must file an amended Arizona income tax return

(Form 140X) to change an election.

Original Election

Amended Election

If one spouse is a full-year resident and the other spouse is a part-year resident or nonresident, the full-year resident

should complete the appropriate column in Part 1 or Part 3, and the part-year resident or nonresident should complete the

appropriate column in Part 2 or Part 4.

For Full-Year Residents Only (Form 140 or 140A)

SPOUSE CLAIMING

SPOUSE CLAIMING

Part 1

Claiming No Dependents

MORE THAN 1/2

LESS THAN 1/2

$

4,200.00 $

4,200.00

1 Total personal exemption allowed married taxpayers claiming no dependents ............................. 1

2 Amount of personal exemption each spouse is claiming on his or her separate Arizona return.

Enter the result here. Also enter the result on Form 140, page 2, line 44, or Form 140A, page 1,

line 19. If one spouse is a nonresident or part-year resident, that spouse should complete

$

.00 $

.00

Part 2 below.................................................................................................................................... 2

For Part-Year Residents (Form 140PY) or

SPOUSE CLAIMING

SPOUSE CLAIMING

Part 2

Nonresidents (Form 140NR) Claiming No Dependents

MORE THAN 1/2

LESS THAN 1/2

$

4,200.00 $

4,200.00

1 Total personal exemption allowed (prior to prorating) married taxpayers claiming no dependents. 1

2 Amount of personal exemption each spouse is claiming (prior to prorating) on his or her

separate Arizona return. If you are a part-year resident who is an active duty military member

who either began or gave up Arizona residency during 2015, skip lines 3 and 4, and

enter this amount on Form 140PY, page 2, line 56. If you are a nonresident who is an active

military member, skip lines 3 and 4, and enter this amount on Form 140NR, page 2, line 54.

$

.00 $

.00

All other taxpayers complete lines 3 and 4 ..................................................................................... 2

3 If you are a part-year resident, enter your Arizona income ratio from Form 140PY, page 1, line 28.

If you are a nonresident, enter your Arizona income ratio from Form 140NR, page 1, line 27 ...... 3

4 Multiply line 2 by the ratio on line 3. If you are a part-year resident, enter the result here

and on Form 140PY, page 2, line 56. If you are a nonresident, enter the result here and on

$

.00 $

.00

Form 140NR, page 2, line 54 ......................................................................................................... 4

ADOR 10167 (15)

1

1 2

2