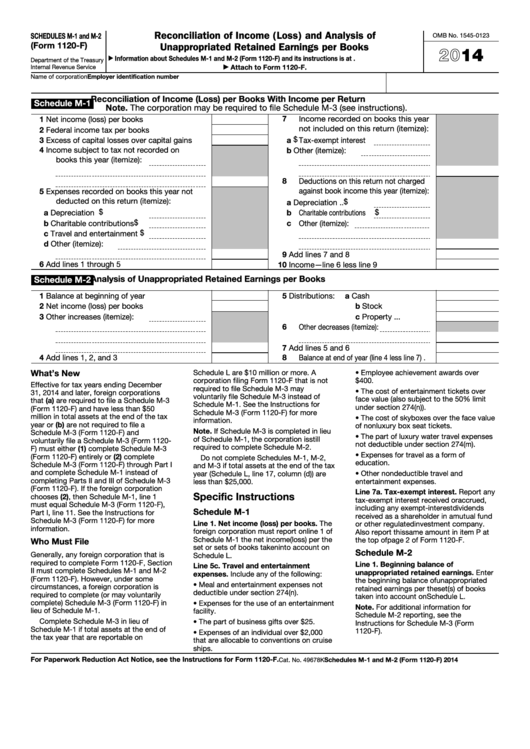

Reconciliation of Income (Loss) and Analysis of

SCHEDULES M-1 and M-2

OMB No. 1545-0123

(Form 1120-F)

Unappropriated Retained Earnings per Books

2014

Information about Schedules M-1 and M-2 (Form 1120-F) and its instructions is at

▶

Department of the Treasury

Attach to Form 1120-F.

Internal Revenue Service

▶

Name of corporation

Employer identification number

Reconciliation of Income (Loss) per Books With Income per Return

Schedule M-1

Note. The corporation may be required to file Schedule M-3 (see instructions).

7

Income recorded on books this year

1

Net income (loss) per books .

.

.

.

.

not included on this return (itemize):

2

Federal income tax per books .

.

.

.

$

3

a

Excess of capital losses over capital gains

Tax-exempt interest

4

Income subject to tax not recorded on

b Other (itemize):

books this year (itemize):

8

Deductions on this return not charged

against book income this year (itemize):

5

Expenses recorded on books this year not

deducted on this return (itemize):

$

a Depreciation

.

.

$

$

a Depreciation .

.

. .

b Charitable contributions

$

b Charitable contributions

c Other (itemize):

c Travel and entertainment $

d Other (itemize):

9

Add lines 7 and 8 .

.

.

.

.

.

.

6

Add lines 1 through 5 .

.

.

.

.

.

.

10

Income—line 6 less line 9 .

.

.

.

Analysis of Unappropriated Retained Earnings per Books

Schedule M-2

1

5

a Cash

Balance at beginning of year

.

.

.

.

Distributions:

.

.

.

.

2

b Stock .

Net income (loss) per books .

.

.

.

.

.

.

.

3

Other increases (itemize):

c Property .

.

.

6

Other decreases (itemize):

7

Add lines 5 and 6 .

.

.

.

.

.

.

4

8

Add lines 1, 2, and 3 .

.

.

.

.

.

.

Balance at end of year (line 4 less line 7) .

What’s New

Schedule L are $10 million or more. A

• Employee achievement awards over

corporation filing Form 1120-F that is not

$400.

Effective for tax years ending December

required to file Schedule M-3 may

• The cost of entertainment tickets over

31, 2014 and later, foreign corporations

voluntarily file Schedule M-3 instead of

face value (also subject to the 50% limit

that (a) are required to file a Schedule M-3

Schedule M-1. See the Instructions for

under section 274(n)).

(Form 1120-F) and have less than $50

Schedule M-3 (Form 1120-F) for more

million in total assets at the end of the tax

• The cost of skyboxes over the face value

information.

year or (b) are not required to file a

of nonluxury box seat tickets.

Note. If Schedule M-3 is completed in lieu

Schedule M-3 (Form 1120-F) and

• The part of luxury water travel expenses

of Schedule M-1, the corporation is still

voluntarily file a Schedule M-3 (Form 1120-

not deductible under section 274(m).

required to complete Schedule M-2.

F) must either (1) complete Schedule M-3

• Expenses for travel as a form of

(Form 1120-F) entirely or (2) complete

Do not complete Schedules M-1, M-2,

education.

Schedule M-3 (Form 1120-F) through Part I

and M-3 if total assets at the end of the tax

and complete Schedule M-1 instead of

year (Schedule L, line 17, column (d)) are

• Other nondeductible travel and

completing Parts II and III of Schedule M-3

less than $25,000.

entertainment expenses.

(Form 1120-F). If the foreign corporation

Line 7a. Tax-exempt interest. Report any

Specific Instructions

chooses (2), then Schedule M-1, line 1

tax-exempt interest received or accrued,

must equal Schedule M-3 (Form 1120-F),

including any exempt-interest dividends

Schedule M-1

Part I, line 11. See the Instructions for

received as a shareholder in a mutual fund

Schedule M-3 (Form 1120-F) for more

Line 1. Net income (loss) per books. The

or other regulated investment company.

information.

foreign corporation must report on line 1 of

Also report this same amount in item P at

Schedule M-1 the net income (loss) per the

the top of page 2 of Form 1120-F.

Who Must File

set or sets of books taken into account on

Schedule M-2

Generally, any foreign corporation that is

Schedule L.

required to complete Form 1120-F, Section

Line 1. Beginning balance of

Line 5c. Travel and entertainment

II must complete Schedules M-1 and M-2

unappropriated retained earnings. Enter

expenses. Include any of the following:

(Form 1120-F). However, under some

the beginning balance of unappropriated

• Meal and entertainment expenses not

circumstances, a foreign corporation is

retained earnings per the set(s) of books

deductible under section 274(n).

required to complete (or may voluntarily

taken into account on Schedule L.

complete) Schedule M-3 (Form 1120-F) in

• Expenses for the use of an entertainment

Note. For additional information for

lieu of Schedule M-1.

facility.

Schedule M-2 reporting, see the

Complete Schedule M-3 in lieu of

• The part of business gifts over $25.

Instructions for Schedule M-3 (Form

Schedule M-1 if total assets at the end of

1120-F).

• Expenses of an individual over $2,000

the tax year that are reportable on

that are allocable to conventions on cruise

ships.

For Paperwork Reduction Act Notice, see the Instructions for Form 1120-F.

Schedules M-1 and M-2 (Form 1120-F) 2014

Cat. No. 49678K

1

1