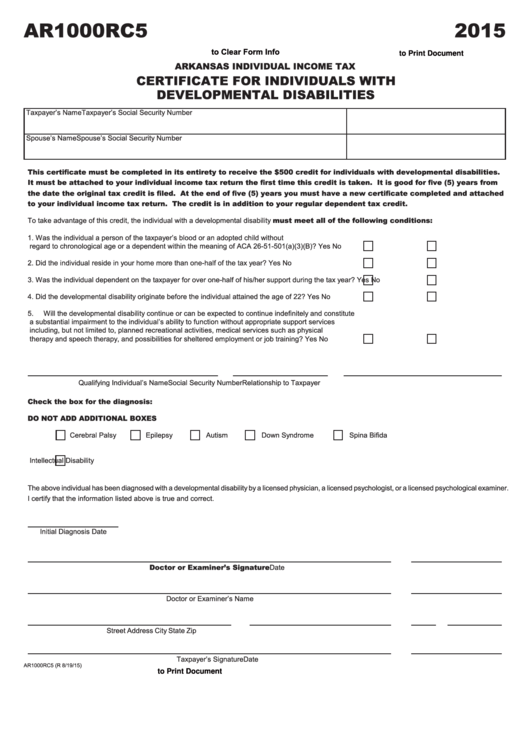

AR1000RC5

2015

Click Here to Clear Form Info

Click Here to Print Document

ARKANSAS INDIVIDUAL INCOME TAX

CERTIFICATE FOR INDIVIDUALS WITH

DEVELOPMENTAL DISABILITIES

Taxpayer’s Name

Taxpayer’s Social Security Number

Spouse’s Name

Spouse’s Social Security Number

This certificate must be completed in its entirety to receive the $500 credit for individuals with developmental disabilities.

It must be attached to your individual income tax return the first time this credit is taken. It is good for five (5) years from

the date the original tax credit is filed. At the end of five (5) years you must have a new certificate completed and attached

to your individual income tax return. The credit is in addition to your regular dependent tax credit.

To take advantage of this credit, the individual with a developmental disability must meet all of the following conditions:

1.

Was the individual a person of the taxpayer’s blood or an adopted child without

regard to chronological age or a dependent within the meaning of ACA 26-51-501(a)(3)(B)?

Yes

No

2.

Did the individual reside in your home more than one-half of the tax year?

Yes

No

3.

Was the individual dependent on the taxpayer for over one-half of his/her support during the tax year?

Yes

No

4.

Did the developmental disability originate before the individual attained the age of 22?

Yes

No

5.

Will the developmental disability continue or can be expected to continue indefinitely and constitute

a substantial impairment to the individual’s ability to function without appropriate support services

including, but not limited to, planned recreational activities, medical services such as physical

therapy and speech therapy, and possibilities for sheltered employment or job training?

Yes

No

Qualifying Individual’s Name

Social Security Number

Relationship to Taxpayer

Check the box for the diagnosis:

DO NOT ADD ADDITIONAL BOXES

Cerebral Palsy Epilepsy Autism Down Syndrome Spina Bifida

Intellectual Disability

The above individual has been diagnosed with a developmental disability by a licensed physician, a licensed psychologist, or a licensed psychological examiner.

I certify that the information listed above is true and correct.

Initial Diagnosis Date

Doctor or Examiner’s Signature

Date

Doctor or Examiner’s Name

Telephone Number

Street Address

City

State

Zip

Taxpayer’s Signature

Date

AR1000RC5 (R 8/19/15)

Click Here to Print Document

1

1