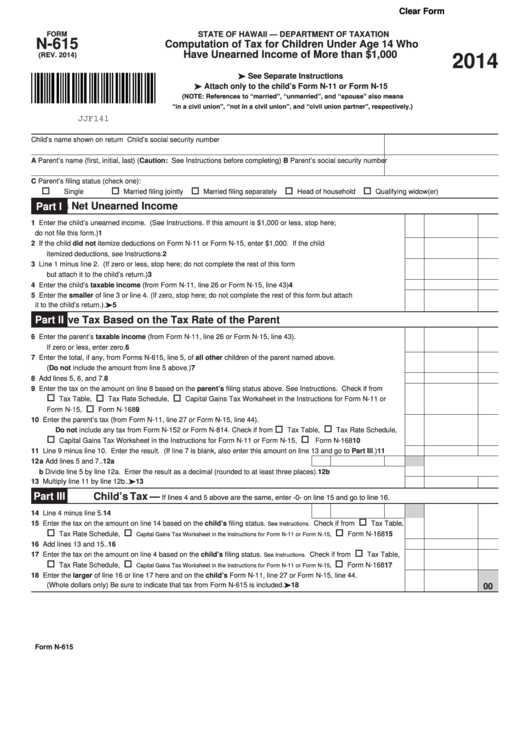

Clear Form

FORM

STATE OF HAWAII — DEPARTMENT OF TAXATION

N-615

Computation of Tax for Children Under Age 14 Who

Have Unearned Income of More than $1,000

(REV. 2014)

2014

See Separate Instructions

Attach only to the child’s Form N-11 or Form N-15

(NOTE: References to “married”, “unmarried”, and “spouse” also means

“in a civil union”, “not in a civil union”, and “civil union partner”, respectively.)

JJF141

Child’s name shown on return

Child’s social security number

A Parent’s name (first, initial, last) (Caution: See Instructions before completing)

B Parent’s social security number

C Parent’s filing status (check one):

Single

Married filing jointly

Married filing separately

Head of household

Qualifying widow(er)

Child’s Net Unearned Income

Part I

1

Enter the child’s unearned income. (See Instructions. If this amount is $1,000 or less, stop here;

do not file this form.) ......................................................................................................................................................

1

2

If the child did not itemize deductions on Form N-11 or Form N-15, enter $1,000. If the child

itemized deductions, see Instructions. ...........................................................................................................................

2

3

Line 1 minus line 2. (If zero or less, stop here; do not complete the rest of this form

but attach it to the child’s return.) ..................................................................................................................................

3

4

Enter the child’s taxable income (from Form N-11, line 26 or Form N-15, line 43) ......................................................

4

5

Enter the smaller of line 3 or line 4. (If zero, stop here; do not complete the rest of this form but attach

it to the child’s return.). ..............................................................................................................................................

5

Part II

Tentative Tax Based on the Tax Rate of the Parent

6

Enter the parent’s taxable income (from Form N-11, line 26 or Form N-15, line 43).

If zero or less, enter zero. ..............................................................................................................................................

6

7

Enter the total, if any, from Forms N-615, line 5, of all other children of the parent named above.

(Do not include the amount from line 5 above.) ............................................................................................................

7

8

Add lines 5, 6, and 7. .....................................................................................................................................................

8

9

Enter the tax on the amount on line 8 based on the parent’s filing status above. See Instructions. Check if from

Tax Table,

Tax Rate Schedule,

Capital Gains Tax Worksheet in the Instructions for Form N-11 or

Form N-15,

Form N-168 ........................................................................................................................................

9

10

Enter the parent’s tax (from Form N-11, line 27 or Form N-15, line 44).

Do not include any tax from Form N-152 or Form N-814. Check if from

Tax Table,

Tax Rate Schedule,

Capital Gains Tax Worksheet in the Instructions for Form N-11 or Form N-15,

Form N-168 .........................

10

11

Line 9 minus line 10. Enter the result. (If line 7 is blank, also enter this amount on line 13 and go to Part III.) ..........

11

12 a Add lines 5 and 7.. .........................................................................................................

12a

b Divide line 5 by line 12a. Enter the result as a decimal (rounded to at least three places). ..........................................

12b

Multiply line 11 by line 12b.. .......................................................................................................................................

13

13

If lines 4 and 5 above are the same, enter -0- on line 15 and go to line 16.

Part III

Child’s Tax —

14

Line 4 minus line 5. ........................................................................................................

14

Enter the tax on the amount on line 14 based on the child’s filing status. See Instructions. Check if from

15

Tax Table,

Capital Gains Tax Worksheet in the Instructions for Form N-11 or Form N-15,

Tax Rate Schedule,

Form N-168 .......

15

16

Add lines 13 and 15.. .....................................................................................................................................................

16

Enter the tax on the amount on line 4 based on the child’s filing status. See Instructions. Check if from

17

Tax Table,

Capital Gains Tax Worksheet in the Instructions for Form N-11 or Form N-15,

Tax Rate Schedule,

Form N-168 .......

17

18

Enter the larger of line 16 or line 17 here and on the child’s Form N-11, line 27 or Form N-15, line 44.

(Whole dollars only) Be sure to indicate that tax from Form N-615 is included. ........................................................

18

00

Form N-615

1

1