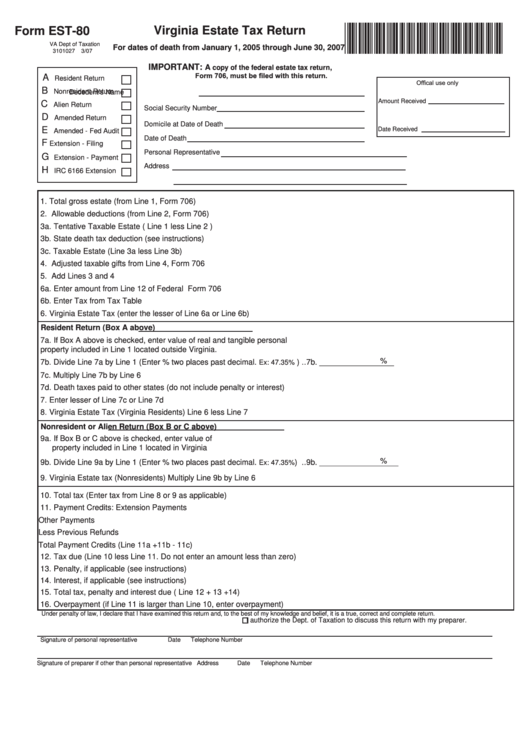

Form Est-80 - Virginia Estate Tax Return

ADVERTISEMENT

*VAET80107888*

Virginia Estate Tax Return

Form EST-80

VA Dept of Taxation

For dates of death from January 1, 2005 through June 30, 2007

3101027

3/07

IMPORTANT:

A

copy of the federal estate tax return,

Form 706, must be filed with this return.

A

Resident Return

Offical use only

B

Nonresident Return

Decedent’s Name

Amount Received

C

Alien Return

Social Security Number

D

Amended Return

Domicile at Date of Death

E

Date Received

Amended - Fed Audit

Date of Death

F

Extension - Filing

Personal Representative

G

Extension - Payment

Address

H

IRC 6166 Extension

1. Total gross estate (from Line 1, Form 706) ..............................................................................................1. _________________

2. Allowable deductions (from Line 2, Form 706) ..........................................................................................2. _________________

3a. Tentative Taxable Estate ( Line 1 less Line 2 ) ..........................................................................................3a._________________

3b. State death tax deduction (see instructions) .............................................................................................3b._________________

3c. Taxable Estate (Line 3a less Line 3b) .......................................................................................................3c. _________________

4. Adjusted taxable gifts from Line 4, Form 706 ...........................................................................................4. _________________

5. Add Lines 3 and 4 ....................................................................................................................................5. _________________

6a. Enter amount from Line 12 of Federal Form 706 .....................................6a. __________________

6b. Enter Tax from Tax Table ............................................................................6b. __________________

6. Virginia Estate Tax (enter the lesser of Line 6a or Line 6b).......................................................................6. _________________

Resident Return (Box A above)

7a. If Box A above is checked, enter value of real and tangible personal

property included in Line 1 located outside Virginia. ..................................7a. _________________

%

7b. Divide Line 7a by Line 1 (Enter % two places past decimal.

) .. 7b. _________________

Ex: 47.35%

7c. Multiply Line 7b by Line 6 ...........................................................................7c. _________________

7d. Death taxes paid to other states (do not include penalty or interest) ........ 7d. _________________

7. Enter lesser of Line 7c or Line 7d .............................................................................................................7. _________________

8. Virginia Estate Tax (Virginia Residents) Line 6 less Line 7 .......................................................................8. _________________

Nonresident or Alien Return (Box B or C above)

9a. If Box B or C above is checked, enter value of

property included in Line 1 located in Virginia ..........................................9a. __________________

%

9b. Divide Line 9a by Line 1 (Enter % two places past decimal.

) .. 9b. __________________

Ex: 47.35%

9. Virginia Estate tax (Nonresidents) Multiply Line 9b by Line 6 ...................................................................9. _________________

10. Total tax (Enter tax from Line 8 or 9 as applicable) ................................................................................ 10. _________________

11. Payment Credits:

Extension Payments ...........................11a. __________________

Other Payments .................................11b. __________________

Less Previous Refunds .......................11c. __________________

Total Payment Credits (Line 11a +11b - 11c) ................................................................. 11. _________________

12. Tax due (Line 10 less Line 11. Do not enter an amount less than zero) ................................................ 12. _________________

13. Penalty, if applicable (see instructions) .................................................................................................. 13. _________________

14. Interest, if applicable (see instructions) .................................................................................................. 14. _________________

15. Total tax, penalty and interest due ( Line 12 + 13 +14) .......................................................................... 15. _________________

16. Overpayment (if Line 11 is larger than Line 10, enter overpayment) ..................................................... 16. _________________

Under penalty of law, I declare that I have examined this return and, to the best of my knowledge and belief, it is a true, correct and complete return.

I authorize the Dept. of Taxation to discuss this return with my preparer.

Signature of personal representative

Date

Telephone Number

Signature of preparer if other than personal representative

Address

Date

Telephone Number

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3