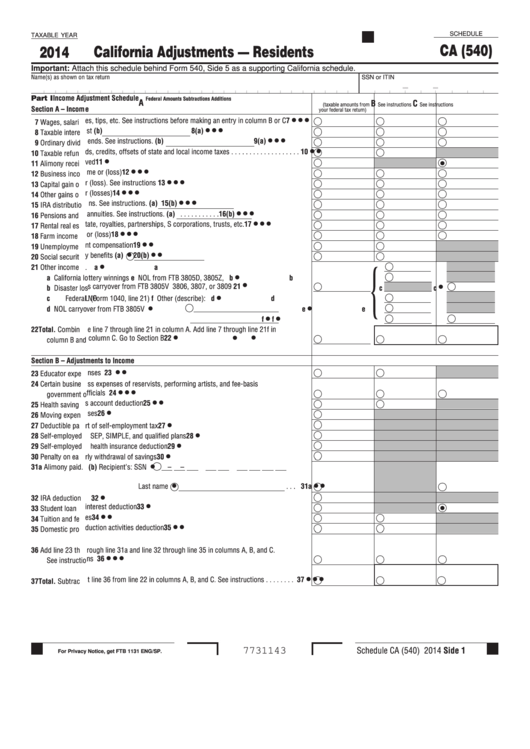

SCHEDULE

TAXABLE YEAR

CA (540)

2014

California Adjustments — Residents

Important: Attach this schedule behind Form 540, Side 5 as a supporting California schedule.

Name(s) as shown on tax return

SSN or ITIN

Part I Income Adjustment Schedule

Federal Amounts

Subtractions

Additions

A

B

C

(taxable amounts from

See instructions

See instructions

Section A – Incom

e

your federal tax return)

7

Wages, salari

es, tips, etc. See instructions before making an entry in column B or C . . . . 7

8

Taxable intere

st (b)

. . . . . . . . . . . . . . . . . . . . . . . . . . . . .8(a)

9

Ordinary divid

ends. See instructions. (b)

. . . . . . . . . . .9(a)

10

Taxable refun

ds, credits, offsets of state and local income taxes . . . . . . . . . . . . . . . . . . . 10

11

Alimony recei

ved . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

12

Business inco

me or (loss) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

13

Capital gain o

r (loss). See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

14

Other gains o

r (losses) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14

15

IRA distributio

ns. See instructions. (a)

. . . . . . . . . . . . . . . .15(b)

16

Pensions and

annuities. See instructions. (a)

. . . . . . . . . . .16(b)

17

Rental real es

tate, royalties, partnerships, S corporations, trusts, etc.. . . . . . . . . . . . . . . 17

18

Farm income

or (loss) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18

19

Unemployme

nt compensation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19

{

20

Social securit

y benefits (a)

. . . . . . . . . . . . . . . . . . . . . . . .20(b)

21

Other income

.

a

a

a California lo

ttery winnings

e NOL from FTB 3805D, 3805Z,

b

b

b Disaster los

s carryover from FTB 3805V

3806, 3807, or 3809

21

c _____________

c

c Federal NO

L (Form 1040, line 21)

f Other (describe):

d

d

d NOL carryo

ver from FTB 3805V

e

e

f

f

22

Total. Combin

e line 7 through line 21 in column A. Add line 7 through line 21f in

column B and

column C. Go to Section B. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 22

Section B – Adjust

ments to Income

23

Educator expe

nses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 23

24

Certain busine

ss expenses of reservists, performing artists, and fee-basis

government o

fficials . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 24

25

Health saving

s account deduction . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 25

26

Moving expen

ses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 26

27

Deductible pa

rt of self-employment tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 27

28

Self-employed

SEP, SIMPLE, and qualified plans . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 28

29

Self-employed

health insurance deduction . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 29

30

Penalty on ea

rly withdrawal of savings. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 30

31a Alimony paid.

(b) Recipient’s: SSN

–

–

Last name

. . . 31a

32

IRA deduction

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 32

33

Student loan

interest deduction . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 33

34

Tuition and fe

es . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 34

35

Domestic pro

duction activities deduction. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 35

36

Add line 23 th

rough line 31a and line 32 through line 35 in columns A, B, and C.

See instructio

ns . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 36

37

Total. Subtrac

t line 36 from line 22 in columns A, B, and C. See instructions . . . . . . . . 37

Schedule CA (540) 2014 Side 1

7731143

For Privacy Notice, get FTB 1131 ENG/SP.

1

1 2

2