Save

Print

Clear

Tab to navigate within form. Use mouse to check

applicable boxes, press spacebar or press Enter.

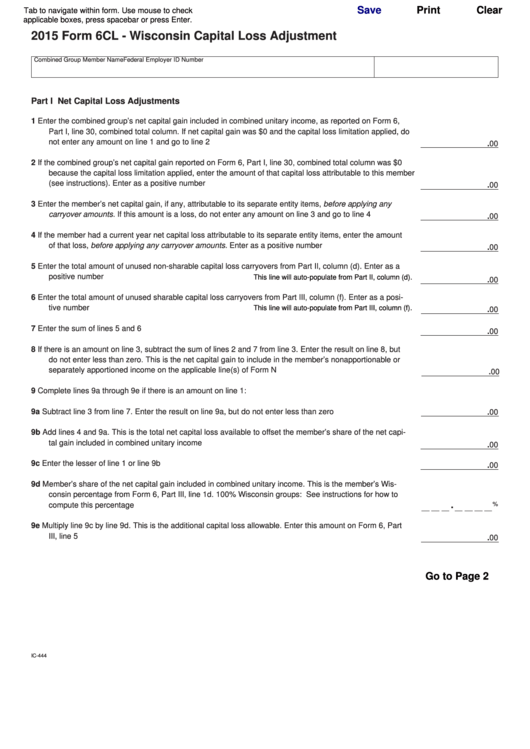

2015 Form 6CL - Wisconsin Capital Loss Adjustment

Combined Group Member Name

Federal Employer ID Number

Part I Net Capital Loss Adjustments

1

Enter the combined group’s net capital gain included in combined unitary income, as reported on Form 6,

Part I, line 30, combined total column. If net capital gain was $0 and the capital loss limitation applied, do

not enter any amount on line 1 and go to line 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

.00

2

If the combined group’s net capital gain reported on Form 6, Part I, line 30, combined total column was $0

because the capital loss limitation applied, enter the amount of that capital loss attributable to this member

(see instructions). Enter as a positive number . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

.00

3

Enter the member’s net capital gain, if any, attributable to its separate entity items, before applying any

carryover amounts. If this amount is a loss, do not enter any amount on line 3 and go to line 4. . . . . . . . .

.00

4

If the member had a current year net capital loss attributable to its separate entity items, enter the amount

of that loss, before applying any carryover amounts. Enter as a positive number . . . . . . . . . . . . . . . . . . . .

.00

5

Enter the total amount of unused non-sharable capital loss carryovers from Part II, column (d). Enter as a

positive number . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

This line will auto-populate from Part II, column (d).

.00

6

Enter the total amount of unused sharable capital loss carryovers from Part III, column (f). Enter as a posi-

tive number. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

This line will auto-populate from Part III, column (f).

.00

7

Enter the sum of lines 5 and 6 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

.00

8

If there is an amount on line 3, subtract the sum of lines 2 and 7 from line 3. Enter the result on line 8, but

do not enter less than zero. This is the net capital gain to include in the member’s nonapportionable or

separately apportioned income on the applicable line(s) of Form N . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

.00

9

Complete lines 9a through 9e if there is an amount on line 1:

9a

Subtract line 3 from line 7. Enter the result on line 9a, but do not enter less than zero . . . . . . . . . . . . . . . .

.00

9b

Add lines 4 and 9a. This is the total net capital loss available to offset the member’s share of the net capi-

tal gain included in combined unitary income. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

.00

9c

Enter the lesser of line 1 or line 9b . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

.00

9d

Member’s share of the net capital gain included in combined unitary income. This is the member’s Wis-

consin percentage from Form 6, Part III, line 1d. 100% Wisconsin groups: See instructions for how to

.

%

compute this percentage . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9e

Multiply line 9c by line 9d. This is the additional capital loss allowable. Enter this amount on Form 6, Part

III, line 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

.00

Go to Page 2

IC-444

1

1 2

2