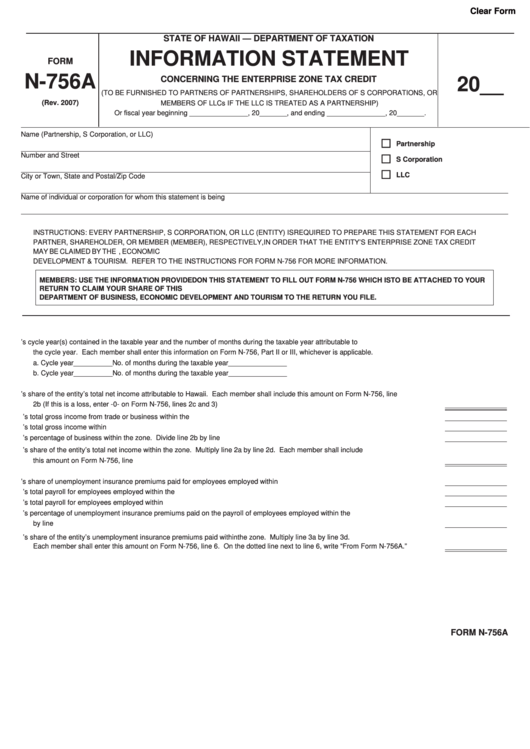

Clear Form

STATE OF HAWAII — DEPARTMENT OF TAXATION

INFORMATION STATEMENT

FORM

N-756A

CONCERNING THE ENTERPRISE ZONE TAX CREDIT

20__

(TO BE FURNISHED TO PARTNERS OF PARTNERSHIPS, SHAREHOLDERS OF S CORPORATIONS, OR

(Rev. 2007)

MEMBERS OF LLCs IF THE LLC IS TREATED AS A PARTNERSHIP)

Or fiscal year beginning _______________, 20_______, and ending _______________, 20_______.

Name (Partnership, S Corporation, or LLC)

¨

Partnership

¨

Number and Street

S Corporation

¨

LLC

City or Town, State and Postal/Zip Code

Name of individual or corporation for whom this statement is being prepared.

SSN or FEIN

INSTRUCTIONS: EVERY PARTNERSHIP, S CORPORATION, OR LLC (ENTITY) IS REQUIRED TO PREPARE THIS STATEMENT FOR EACH

PARTNER, SHAREHOLDER, OR MEMBER (MEMBER), RESPECTIVELY, IN ORDER THAT THE ENTITY’S ENTERPRISE ZONE TAX CREDIT

MAY BE CLAIMED BY THE MEMBER. ATTACH A COPY OF THE CERTIFICATION ISSUED BY THE DEPARTMENT OF BUSINESS, ECONOMIC

DEVELOPMENT & TOURISM. REFER TO THE INSTRUCTIONS FOR FORM N-756 FOR MORE INFORMATION.

MEMBERS: USE THE INFORMATION PROVIDED ON THIS STATEMENT TO FILL OUT FORM N-756 WHICH IS TO BE ATTACHED TO YOUR

RETURN TO CLAIM YOUR SHARE OF THIS CREDIT. ALSO ATTACH A COPY OF THIS FORM AND THE CERTIFICATION ISSUED BY THE

DEPARTMENT OF BUSINESS, ECONOMIC DEVELOPMENT AND TOURISM TO THE RETURN YOU FILE.

1. Entity’s cycle year(s) contained in the taxable year and the number of months during the taxable year attributable to

the cycle year. Each member shall enter this information on Form N-756, Part II or III, whichever is applicable.

a. Cycle year __________

No. of months during the taxable year _______________

b. Cycle year __________

No. of months during the taxable year _______________

2a. Member’s share of the entity’s total net income attributable to Hawaii. Each member shall include this amount on Form N-756, line

2b (If this is a loss, enter -0- on Form N-756, lines 2c and 3) ..................................................................................................................

b. Entity’s total gross income from trade or business within the zone .........................................................................................................

c. Entity’s total gross income within Hawaii .................................................................................................................................................

d. Entity’s percentage of business within the zone. Divide line 2b by line 2c .............................................................................................

e. Member’s share of the entity’s total net income within the zone. Multiply line 2a by line 2d. Each member shall include

this amount on Form N-756, line 2a.........................................................................................................................................................

3a. Member’s share of unemployment insurance premiums paid for employees employed within Hawaii ...................................................

b. Entity’s total payroll for employees employed within the zone.................................................................................................................

c. Entity’s total payroll for employees employed within Hawaii....................................................................................................................

d. Entity’s percentage of unemployment insurance premiums paid on the payroll of employees employed within the zone. Divide line 3b

by line 3c..................................................................................................................................................................................................

e. Member’s share of the entity’s unemployment insurance premiums paid within the zone. Multiply line 3a by line 3d.

Each member shall enter this amount on Form N-756, line 6. On the dotted line next to line 6, write “From Form N-756A.” ................

FORM N-756A

1

1